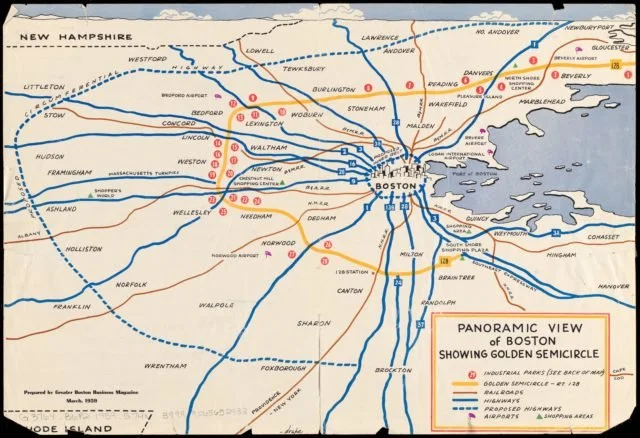

Boston area’s ‘Golden Semicircle’

A 1959 issue of Greater Boston Business Magazine contained a two-page map of the region’s “Golden Circle” showing industrial parks and shopping centers springing up along Route 128, which was being completed.

The building of Route 128 created was the nation’s first great high-technology region, fueled by the university complex in and around Boston. It was something of a model for North Carolina’s Research Triangle and what came to be called Silicon Valley in the San Francisco-San Jose area in California.

—Image courtesy of the Boston Public Library/Digital Commonwealth |

A WPA for transportation?

From Robert Whitcomb’s “Digital Diary,’’ in GoLocal24.com

Traffic is starting to back up again in southern New England roads as the economy opens up in fits and starts. I found it bumper to bumper for a while the other week on Route 128 west of Boston. The roads are crumbling and the environmental effects of our extreme car-dependence are obvious. We need to expand mass transit. Yes, fear of COVID-19 has taken a toll on transit ridership but the frustrations and dangers of car travel (far more dangerous than travel on trains and buses) will soon enough send many people back to the likes of the MBTA.

Meanwhile, gasoline prices are very low and will likely continue so for some time to come. So when this depression ends, gasoline taxes should be raised to make the long-delayed improvements in transportation that will be good for the environment and for the economy. Maybe some people left permanently jobless by the pandemic depression can be employed in (Great Depression-era) WPA-style work to help fix the region’s worst transportation problems.

A WPA road project, in the Great Depression

Beauty amidst the traffic jams

Bucolic stretch of the Charles River

Even along such usually depressing stretches as Route 128, fall foliage can be exhilarating, as I appreciated the other day while in a long slowdown on that infamous but economically essential road. There’s one bucolic stretch, near the Charles River, that must look pretty much as it did before Europeans arrived, if you narrow your gaze.

I love the show when the first hard freeze of the season causes so many leaves to fall off the trees in a few hours. But then we have to put up with weeks of shrieking leaf blowers.

— Photo by Anthony Appleyard

Red States/Blue States: Taxes and poverty

From Robert Whitcomb's "Digital Diary,'' in GoLocal24.com:

President Trump and congressional Republicans have floated the idea of eliminating the deductibility of state and local taxes on federal personal-income-tax forms. (That would hit upper-middle-class people in southern New England hard.) Not coincidentally this would most affect affluent Blue States, most importantly New York and California, which have high taxes and extensive public services. It’s all part of a much broader plan to slash taxes for Trump and other very rich people, especially those who, like the president, have non-publicly traded companies that take in “pass-through’’ income that goes directly to the owners.

Because evenhuge blue New York and California have GOP congresspeople and they would join their Democratic colleagues in fighting for that deductibility, it seems at the moment that the changewon’t be made.

In any case, the issue reminds me of the gross differences in tax policies between the states. The Red States tend to have lousy public services, high poverty, no or low state income taxes but high sales taxes, which are regressive – they disproportionately hit the middle class and the poor.

Red States tend to disproportionately represent the interest of rich people and big business, who, of course, like most of us, seek to pay as little in taxes as possible. These interests have relatively more power in Red State legislatures and governorships than in Blue States, whose citizens tend to demand stronger state government roles in education, social services, the environment and some other sectors, and thus tolerate higher taxes.

And these better public services pay off: Blue States remain as a group much richer than Red States and with better metrics on health, education, poverty, environment and physical infrastructure, including water and transportation. Indeed, one of the surprises, perhaps, over the last few decades is how the politically powerful (they control the legislative, executive and (mostly) the judicial branches) Red States still lag way behind the Northeast, with its hefty income taxes (except New Hampshire), in so many socio-economic ways.

The fact is that most people are still better off in the Northeast, even as they complain about our taxes. And the two greatestentrepreneurial, innovation and invention centers in America are Silicon Valley, in high-tax California, the Boston-Cambridge-Route 128 complex in high-tax Massachusetts, and the great wealth creator of very-high-tax, high-public-service New York City.

The worst poverty in America remains in the most Red States, and their tax systems, geared to the personalinterests of plutocrats such as the Koch Brothers, helps explain why.

Of course many well-off retirees will move to Florida from the Northeast for the weather and to avoid income taxes. They no longer need good schools for their children, who have long since grown. Then when get really old, many move back to be taken care of by their children and take advantage of social services, such as mass transit, that are lacking in Florida (which I suppose might be more precisely called a Purple State).

Abandon all hope ye who enter here

Route 128 in Canton, Mass.

Take cover! As part of a bridge project, Route 128 will be closed from the night of Nov. 4 through Nov. 6 in Needham, with trafficto be rerouted through local roads. Even though this will be on a weekend and with plenty of official warning, expect chaos! With all the whining about the MBTA, thank God that Greater Boston, unlike many U.S. metro areas, at least has a fairly dense mass-transit system to take pressure off the roads. If only it were denser.

-- Robert Whitcomb