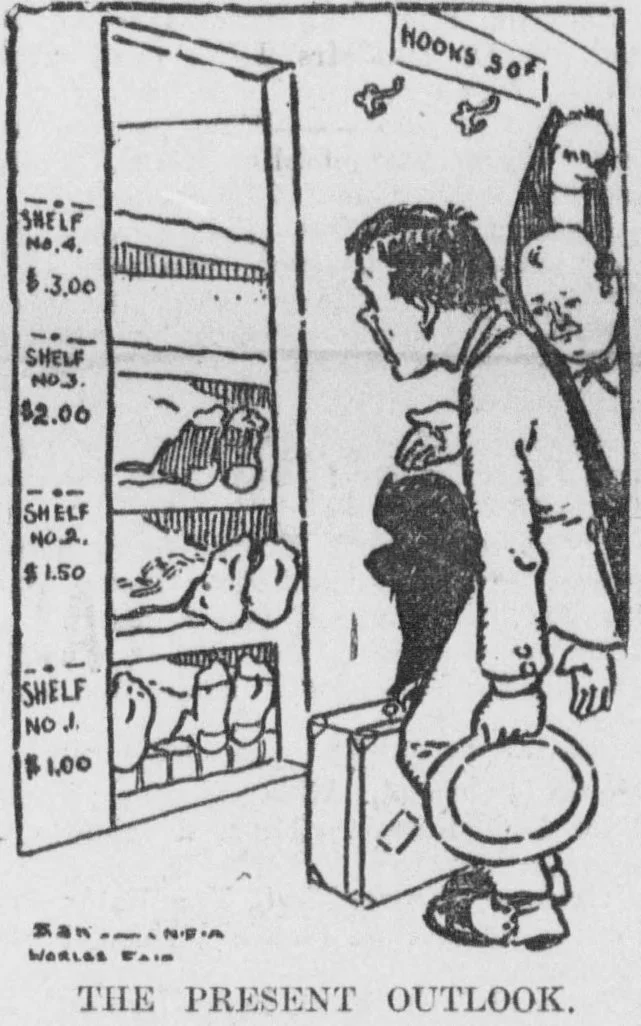

For more evidence that Connecticut's economy has passed the tipping point and is locked into reverse, consider the legislation recently reported favorably by two General Assembly committees to penalize large employers $1 for every hour worked by every employee who isn't paid at least $15 per hour.

As with recent proposals to raise minimum wages throughout the country, the premise of this legislation is that every full-time job should pay a “living wage,” a wage large enough to support a family -- that people should not be paid more or less in relation to the value produced by their labor, the method traditionally used in a market economy, but paid according to their need, as determined by government.

But the legislation doesn't define necessary terms. How big a family exactly and at what stage of life? Exactly what living conditions -- what sort of dwelling, cars, amenities? And who is to decide these variables to make a master assessment of need? What state government agency is equipped for that, or will one have to be created some place between the Office of Early Childhood and the Permanent Commission on the Status of Women?

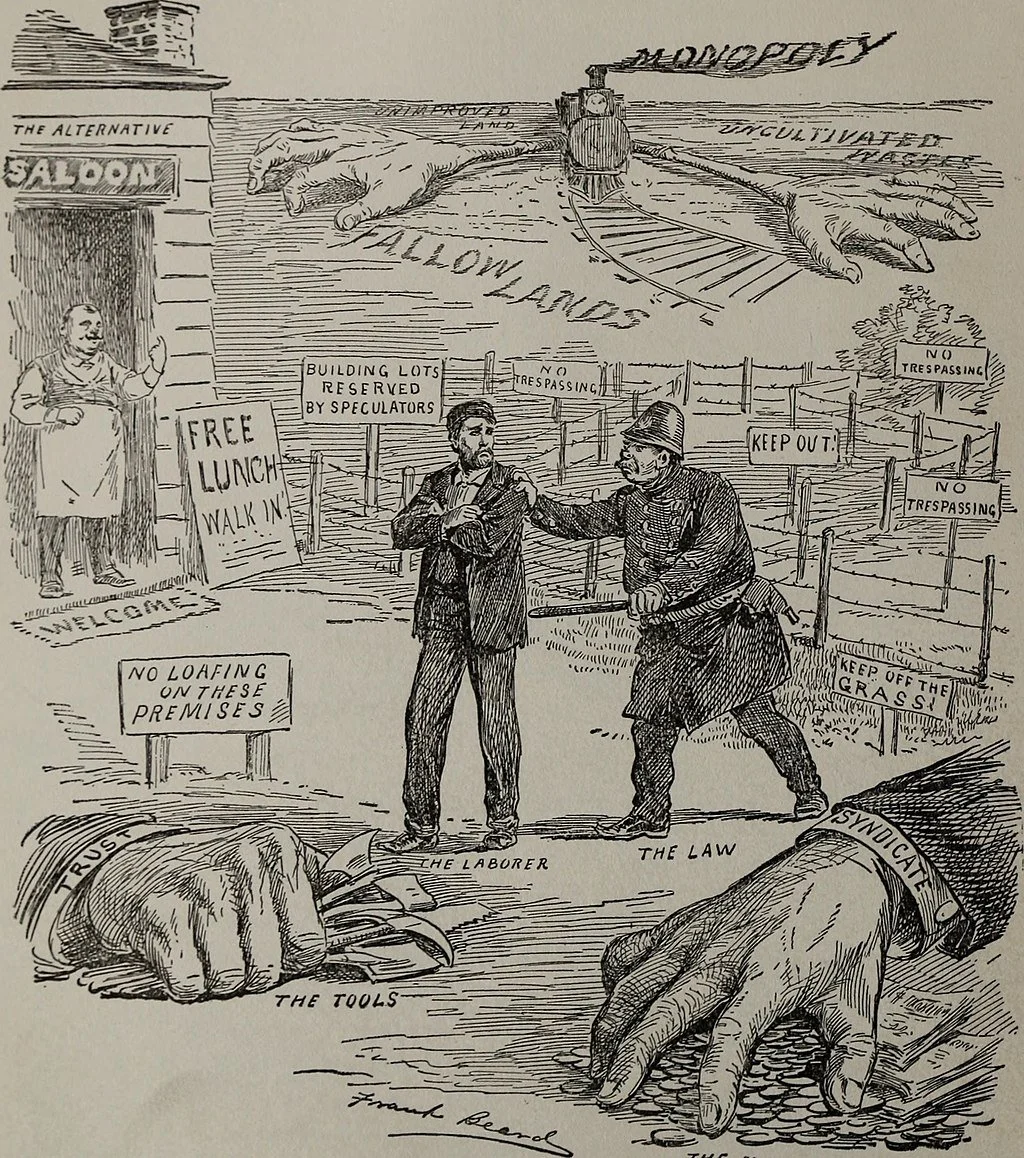

Advocates of the legislation claim that big companies that don't pay their employees at least $15 per hour are being subsidized by the various income supports and welfare stipends given by the government to the working poor. The advocates say the dollar-per-hour tax on such companies will recover some of government's expense.

But the level of welfare benefits is a matter of the discretion of government itself, not employers. That government now considers even cellphone service to be a necessity and has begun providing it as a welfare benefit suggests that such benefits are highly arguable. That people merely want rather than need cellphones hardly establishes that a large employer is bad or underpaying them.

Further, there does not seem to be any mechanism in the legislation to prevent companies from recovering the new tax by reducing wages, transferring the tax from companies to their employees and actually worsening the circumstances of the working poor. But then the legislation may be meant mainly to improve the financial circumstances of state government itself so that it may blithely continue to pay salary and benefit increases to its own employees and those of local government even as the state budget deficit grows.

Judging from the examples cited by the wage legislation's advocates, the essential problem here seems to be that tens of thousands of unmarried, uneducated and largely unskilled women with several children, often by different fathers who are not contributing to the support of their offspring, cannot survive in Connecticut without government subsidies in the only sort of work available to them, low-skilled jobs in food service and other retailing.

The governor and legislators refuse to note this social disintegration and its facilitation by welfare policy. They also refuse to note that, because of the state's comprehensive policy of social promotion in education, two-thirds of Connecticut's high school seniors and public college freshmen have not mastered high school math and half have not mastered high school English but have been given high school diplomas anyway and sent into the workforce grossly unprepared for anything but similar low-skilled employment.

So instead state government will blame McDonald's and Walmart.

Connecticut's policies lately have given it the reputation as the most pro-labor and anti-business state even as the state's economic and population declines have continued into a third decade. Connecticut now excels at giving things away but it is hard to find any business willing to locate or expand here to produce something without a direct cash subsidy from state government.

Of course correlation is not causation but a little curiosity might be in order, if only as an academic exercise for warning other states about what not to do.

Chris Powell is managing editor of the Journal Inquirer, in Manchester, Conn.