Anders Corr/Kyoko Sato: Dreamy scapes of oil paint

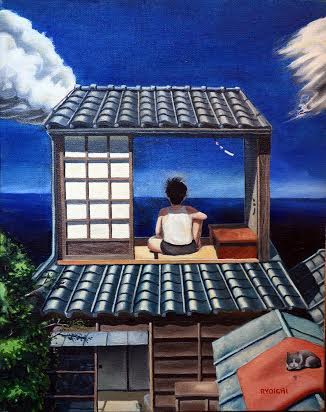

“Summer Winds” (oil on canvas, 1984), by RYOICHI MIURA. Courtesy of Kamakura Shirts Collection, Kanagawa, Japan.

“Summer Winds” (oil on canvas, 1984), by RYOICHI MIURA. Courtesy of Kamakura Shirts Collection, Kanagawa, Japan.

A boy sits on a miniscule tatami (a mat) on the second floor of a miniature house, gazing at the Pacific Ocean. A kitten sleeps on a pillow. Sounds of waves and wind chimes wash over a bicycle and tobacco box obscured by shadow on the ground floor. It’s a summer day in Japan.

The self-taught painter Ryoichi Miura (b. Japan 1956-) dreamed, in black and white, the scene painted in “Summer Winds”. He met us last week at the Harvard Club of New York City and over a summertime special of chilled avocado soup recounted his inspiration for the painting. “I wanted to color the scene. It was so unique to me because I had never seen a monochrome dream”. He just closed the show “Summer: Gallery and Invited Artists” (July 28-Aug. 15) at the Prince Street Gallery in New York.

A dreamy, deformé style epitomizes Ryoichi’s paintings. His signature and contemporary aesthetic is rooted in Garo, a monthly manga (comics) magazine (Seirindo, Japan, 1964-2002). “A big brother of my friend showed me the issue of July 1968 when I visited their home. I saw Ernest Hemingway’s The Killers, a comic {book} by Maki Sasaki. I was totally shocked and I could not move at all!”

Miura immediately asked his mother to subscribe to the magazine. When the bookstore hand-delivered his first issue, as was the norm in the 1960s, Miura jumped from the bathtub and ran dripping, merely covered by a towel, to receive it from the delivery man.

Ryoichi became an artist from that point. He drew his first manga, and brought it to school. His teacher read it aloud in the classroom. He still feels pride that everyone in the classroom, including his teacher, admired the art. Miura painted his first oil painting when he was 13, and has painted ever since. One of his earliest paintings still hangs in the principal’s room of his junior high school, Miura proudly recounts, 46 years later. Miura is now 59.

The earliest influence from manga is delightfully visible in his current art. Illustrations in his children’s book, Kids in N.Y. (Kaiseisha, Japan, 2003), are eerily angled, imbalanced, falling. “New York City is always moving. I wanted to express its movement and speed of the city.”

Miura is the Edward Hopper (American, 1882-1967) of his moment in New York City. Like Hopper, Miura’s paintings are lonely, urban, stark, transitory, estranged, anxious and tightly cropped. Yet Miura is hotter, faster, and more emotional.

Miura, above all, wants to communicate emotion. “I see a scene that gives me an emotional response,” he said. “I want the viewers of my paintings to feel this moment of emotion, the color, the movement.” His medium is important to his message. “I can express it [emotion, color, and movement] only because I am using oil, not camera.” Only with oil and the texture of paint, for example, does he believe that he could paint the smile of a woman, what became his favorite painting, in vermillion red. He says he will never be able to paint such a piece again, and has refused to sell it to buyers.

Ms. Tamiko Sadasue purchased “Summer Winds” in 2013 at the Prince Street Gallery because it symbolizes old Japan – a simpler time after World War II when she was a young girl and Japan had a dream. The painting hangs in Kanagawa Japan at the head office of her company, Kamakura Shirts, as a symbol of Japan’s dream of a prosperous future linked to a simpler, Hopperesque past.

While other artists chase new media, Miura sees value in the classical medium of oil. “I need to wait for 2 weeks for drying, always takes long, need to make tremendous efforts to finish a work. That is valuable for me, especially because we are living in such a convenient world,” says Miura. “I have many more objects and themes I want to paint. Through my paintings, I would like to show my own worlds with my own colors and textures to the people.“

Miura’s dream of painting color into the black and white, proceeds apace with the speed of New York City.

Anders Corr, Ph.D., founded Corr Analytics in 2013. Ms. Kyoko Sato is a curator in New York City.

PCFR speakers from far and wide

Speakers at the 2014-15 season of the Providence Committee on Foreign Relations (thepcfr.org) were:

Anders Corr, a geopolitical analyst and former Defense Department official in Afghanistan, on Chinese expansionism.

Richard George, former high National Security Agency official, on international cyber-security.

Prof. Evodio Kalteneker, on the Brazilian economy and politics.

Professor and journalist Janet Steele on democratic Indonesia.

Jennifer Yanco, a public-health expert and a director of the West Africa Research Association, on the Ebola crisis.

Australian Consul Gen. Nick Minchin, on his nation’s relations with Asia and the U.S.

Delphine Halgand, a high official of the Paris-based Reporters Without Borders, on threats to free speech and journalism. (She spoke a few days after the Charlie Hebdo massacre.)

Amir Afkhami, M.D., a psychiatrist, on dealing with mental illness in war zones, particularly the Mideast.

Military historian and retired Army Colonel Andrew Bacevich on why America should stop fighting wars in the Mideast.

Famed Canadian journalist Diane Francis on why the U.S. and Canada should consider merging.

International landscape architect Thomas Paine on making cities more humane, especially in China.

Admiral Robert Girrier, deputy chief of the U.S. Pacific Fleet, on countering Chinese expansion in the South China Sea.

Gary Hicks, deputy chief of mission in Libya at the time of the Benghazi attack and now at the Center for Strategic and International Studies on lessons for the U.S. in Libya and the future of international trade.

The new season looks exciting too. (And maybe even useful for investing decisions.)

We’re still penciling in speakers and dates, but we can say that Cuban-American businessman and civic leader Eduardo Mestre will speak on Sept. 30 about the reopening of diplomatic relations between the U.S. and the land of his birth.

Mr. Mestre is a member of the boards of the International Rescue Committee and the Cuba Study Group.

He’s also a senior adviser at Evercore and was previously vice chairman of Citigroup Global Markets and chairman of its Investment Banking Division. Before then, he headed investment banking at Salomon Smith Barney and its predecessor firms from 1995-2001 and was co-head of Salomon Brothers' mergers and acquisitions department in 1989-1995.

Skedded for Oct. 22 is Scott Shane, the New York Times reporter who wrote the new book Objective Troy, about Anwar al-Awlaki, “the once-celebrated American imam who called for moderation after 9/11, but a man who ultimately directed his outsized talents to the mass murder of his fellow citizens’’ and was eventually killed by an American drone. Among other things, he’ll discuss the moral issues raised by the increasing use of drones.

Some of the people we have on the drafting board for the rest of the season:

A U.N. expert on international refugee crises; a journalist or diplomat who will discuss the Greek crisis; a member of the Federal Reserve Board who will discuss international financial-system challenges; a Japanese journalist to talk about that nation’s increasingly muscular regional posture; an expert on international shipping in light of the widening of the Panama Canal; a status report on Mexico; a Chinese philanthropist; a member of the Ukrainian Congress Committee; (we have been trying for some time to get a Russian official or journalist to give Moscow’s side of the war in eastern Ukraine), and the director of the Aga Khan University Media School to talk about training journalists in the Developing World

All subject to change. We frequently repeat Prime Minister Harold Macmillan’s purported response when he was asked what he most feared:

“Events, my dear boy, events.’’

Members should feel free to chime in with suggestions.

Also, we’ll strive to frequently update the PCFR Website with supplemental news and commentary on international matters that may be of interest.

Please consult www.thepcfr.org or message pcfremail@gmail.com for questions about the PCFR.

Enjoy the rest of the summer!

Robert Whitcomb, chairman

pcfremail@gmail.com

Anders Corr: Professor trying to protect us in Chinese-food fight

Boston.com and Slate Magazine recently poked fun at a young Harvard Business School professor whom I have counted as a close friend for more than 10 years. Ben Edelman ordered Chinese take-out from an online menu that was out-of-date, with prices $4 lower than the restaurant charged him.

He got into a funny e-mail exchange with the owner of the restaurant, a likeable bartender in Boston named Ran. Ben (being Ben) asked for treble-damages -- $12. As he pointed out in the e-mails, treble damages is his right under Massachusetts law, and provides a good incentive not to defraud.

Of course, this story got the interest (and laughs) of writers at boston.com and Slate, and the articles resulted in thousands of likes, op-eds, posts and retweets. Everyone was laughing at “Professor Cranky Pants.” Even me. I immediately hit send on a finger-wagging e-mail telling Ben that he should pick his battles more wisely.

Another restaurant then forwarded 2011 e-mails from Ben about a Groupon coupon that the restaurant sold, but on which the restaurant did not honor its commitments in the fine print. The restaurant did not cover the fixed-price option. Again this looks on first blush to be a man who is not picking his battles wisely. Ben apologized on his Web site.

But after sleeping on it and speaking with other friends of Ben, I realized that if everyone acted as did Ben, the world would be a better place. Most of us just ignore the likes of a $4 overcharge because we have "better things to do," don't want to rock the boat or otherwise fear conflict. But that means that the next guy who orders Chinese takeout also gets overcharged a few bucks. Over years, that can mean tens of thousands of dollars for one restaurant. Multiplied by thousands of small restaurants, taxis, dry cleaners, lawyers, physicians, contractors and other small businesses, small-time fraud can mean billions of dollars filched every year.

We have all experienced petty fraud. Physicians have tried to get me to undergo procedures I later found were totally unnecessary. Taxi drivers have taken me on long, allegedly “fast’’ routes dozens of times in cities around the world. One even seemed to be spinning his wheels (and his meter) on purpose, consequently fishtailing all over the road, during a snowstorm. Grocery stores have charged me for items I never bought.

Did I take the time to challenge these businesses for a buck or two? Never. It didn't seem worth it. Who knows if that crazy cabbie will pull a crowbar on me? Does this mean that these businesses have little incentive to fix their overcharging? Yes. In fact, they have an incentive to overcharge: Petty fraud is a big source of often cost-free revenue. Not taking action leaves the problem to harm others.

It's a classic public-goods problem -- going after petty fraud helps everyone, but almost nobody is properly incentivized to enforce the law against small-time fraud. Even public prosecutors prefer the big cases that get them media attention and votes. If more of us took Ben's approach, fewer petty fraudsters and fewer bartenders with no incentive to fix their out-of-date menus would nickel and dime us to death. With more Ben-like attitude, we would live in a far better world.

Consider the good that Ben has done in his crusades against fraud. Ben told me a long time ago that in his public high-school in Washington, D.C., he found that heavy chains and a padlock were used to permanently lock an emergency door that by law should not be locked during school hours. If a fire had happened, this could have caused death or injury to a lot of kids.

Ben took a picture of the chained door, with a time-stamp, during school hours, and at some risk to his academic career given the power of his principal, pressured the school to henceforth keep it unlocked during school hours.

Ben is not only risk-acceptant, as pointed out by another defense of his counter-petty fraud activity, he is the kind of guy who loves to read the fine print. He found American Airlines and others lying about nonexistent “taxes” that were actually fees. He got the U.S. Department of Transportation to fine American Airlines, and ever since they aren't defrauding millions of customers in this way. That means that Ben has saved me a few bucks, since I fly American. Thanks Ben!

A couple years ago, Ben realized that Facebook was telling advertisers who its users were (including our names!) whenever we clicked Facebook ads. Facebook had repeatedly promised that it would never do this. Ben told The Wall Street Journal and it was front-page news. Facebook still gives away our names, but at least now explains itself and we know what Facebook is up to. I'm less likely to click those ads, and maybe I get less spam as a result. Thanks Ben!

Even Google's tricks against its customers have been discovered, and revealed, by Ben (who happens to know how to program Web-bots). He used those bots once to discover the Web pages, for example on human-rights stuff, that dictators in China and elsewhere censor from their people. I bet that those folks are happy that someone is looking out for their interests.

See:

https://cyber.harvard.edu/filtering/china/

https://comparite.ch/chinavpnstudy

The Groupon e-mails are part of Ben’s bigger concern for the common man. He was quoted in 2011 in Forbes, where he raised the issue of potential consumer-protection violations by Groupon. When a consumer buys a Groupon from a restaurant or other business, that consumer has the right to expect that the terms of the fine print of that Groupon will be honored. When a restaurant fails to honor a promise it sells, the consumer who purchased that agreement takes a hit. This is petty fraud, and when summed across all Groupon restaurants, could result in millions of dollars of losses to consumers every year.

As with the Groupon dispute, most of Ben's attention is on big brand-name or big-time fraud and other malfeasance resulting in potentially millions or even billions of dollars of costs spread out thinly over all of us. He rightly gets a lot of positive attention for his work.

The Chinese take-out incident, however, reveals something even more extraordinary about Ben than all his achievements. He sent the e-mails not expecting that they would become public and give him fame. They were not meant to advance his career or make him money. $12 doesn't matter to Ben. His efforts resulted from a sense of injustice, and led him to inform a small proprietor of his duties, with an appeal to moral principles and the rights of him and others under the law.

Did it look a little silly when put in the newspaper? Definitely. But Ben took time from his other "more important" pursuits to stand up for a principle. He made an effort to hold the small businessman accountable, expecting nothing in return, as he does when he holds Google or the airlines accountable for billions of dollars of fraud.

Ben is a man of principle, and attempts to be a protector of all of us. Let's learn from Ben and stand up for ourselves when overcharged $4; by doing so, we stand up for each other. Ben's earnest concern for the little guy's nickels and dimes may seem silly at first. But Ben stands on principle, and those nickels and dimes can really add up.

Anders Corr, Ph.D., is principal of Corr Analytics Inc. (www.canalyt.com), which provides strategic analysis of international politics. He is also the editor of the Journal of Political Risk (www.jpolrisk.com). His areas of expertise include global macro analysis, quantitative analysis and public opinion. Dr. Corr maintains a global network of regional and subject-specific political risk experts.

Then there's the South China Sea...

Most of Americans' recent interest, such as they have it, in foreign affairs has been focused on the Islamic State, Russia's invasion and seizure of large parts of Ukraine and the Ebola epidemic.

But meanwhile, they hardly notice another big story -- China's attempt to gradually gain control of the whole South China Sea, with its hefty supplies of oil and natural gas and other resources. So I'm looking forward to hearing international geo-political risk analyst Anders Corr talk about the South China Sea at the monthly meeting of the Providence Committee on Foreign Relations tonight.

-- Robert Whitcomb