Chris Powell: ‘Mansion tax’ wouldn’t help address Conn. housing crisis

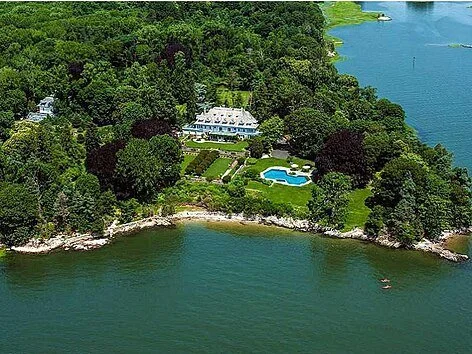

The Lauder Greenway Estate, in Greenwich, Conn.

MANCHESTER, Coon.

Apparently you don't have to do much thinking to run a "think tank" in Washington, or at least not a liberal "think tank." The Connecticut Mirror reports that two such "think tanks" -- the Center on Budget and Policy Priorities and the Institute on Taxation and Economic Policy -- have produced a study concluding that Connecticut could raise tens of millions of dollars every year to spend on reducing homelessness (or spend on something else) by imposing an extra conveyance tax on the state's most expensive homes.

Well, duh! Connecticut could get that kind of money by raising taxes or imposing new ones on nearly anything, not just property transfers.

What is the connection between Connecticut's desperate shortage of housing and its most expensive homes? There isn't one. The mansions of "mansion tax" proposals aren't why the state is short of housing and why housing prices have been rising so fast. While mansions typically occupy larger lots, Connecticut remains full of vacant land and, especially in its cities, decrepit former industrial and residential sites. The state has plenty of room for more housing. Land hogging by the wealthy is not getting in the way.

Connecticut's housing shortage has four major causes.

First is the soaring inflation of the last few years, engineered, in my view, by President Biden and Congress. This has driven up prices and mortgage rates far faster than the incomes of ordinary people. People who own residential and other substantial property, especially the wealthy, profit from inflation, but most others suffer from it.

Another cause is the flood of illegal immigration, a matter of Democratic Party policy on both the federal and state levels. It may be no coincidence that the number of illegal immigrants estimated to be living in Connecticut, more than 100,000, is close to the number of housing units the state is said to lack.

A cause of longer duration is exclusive zoning in suburbs and rural towns, zoning that discriminates against less expensive housing, particularly apartments and condominiums. Such zoning generally has community support, since most people don't want their neighborhoods to become more crowded, though of course their own arrival may have increased the neighborhood's population.

Exclusive zoning has its own cause. In some places exclusive zoning arose long ago from racism or ethnic or religious bigotry. But for many years now exclusive zoning has been sustained mainly by fear of poor people generally, a fear largely justified by the disaster inflicted on the cities, their residents, and everyone else by mistaken state and federal welfare and education policies. People don't want the pathologies of poverty -- fatherlessness, child neglect, crime, ignorance, indolence, and dependence -- imported into their neighborhoods by new housing accessible to the poor. This fear has produced zoning and community opposition that now often obstruct even middle-class, owner-occupied housing.

State government has responded with a law that weakens the use of exclusive zoning against housing, but it hasn't been very effective, and in any case inflation, declining real wages, and illegal immigration still stand in the way.

That's why that Washington "think tank" study on raising taxes on the sale of "mansions" and a similar proposal by state Senate President Martin M. Looney (D.-New Haven), to impose a punitive statewide property tax on "mansions" are so dishonest. While these ideas will raise money, there's no guarantee that much of it will be spent to build housing. More likely the money will be used as most extra tax revenue in Connecticut is used -- to pay the compensation of government's own employees, the Democratic Party's campaign army, while punitive taxes on "mansions" provide camouflage for the real objective.

Housing supply can be increased without punitive taxes on large homes -- by stopping inflation, enforcing immigration law, having state government cover all extra school and police costs of new housing, and revoking the welfare and education policies that manufacture poverty.

But that would take the fun out of blaming "mansions" for the declining living standards caused by elected officials who style themselves defenders of the poor even as they make poverty worse.

Chris Powell has written about Connecticut government and politics for many years (CPowell@cox.net).