Chris Powell: ‘Mansion tax’ wouldn’t help address Conn. housing crisis

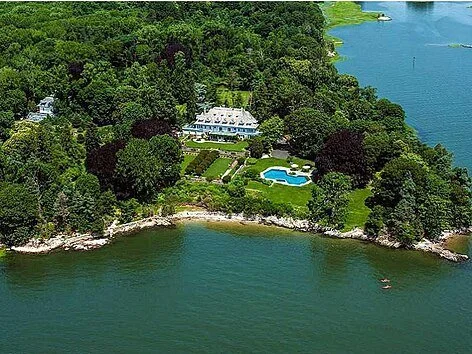

The Lauder Greenway Estate, in Greenwich, Conn.

MANCHESTER, Coon.

Apparently you don't have to do much thinking to run a "think tank" in Washington, or at least not a liberal "think tank." The Connecticut Mirror reports that two such "think tanks" -- the Center on Budget and Policy Priorities and the Institute on Taxation and Economic Policy -- have produced a study concluding that Connecticut could raise tens of millions of dollars every year to spend on reducing homelessness (or spend on something else) by imposing an extra conveyance tax on the state's most expensive homes.

Well, duh! Connecticut could get that kind of money by raising taxes or imposing new ones on nearly anything, not just property transfers.

What is the connection between Connecticut's desperate shortage of housing and its most expensive homes? There isn't one. The mansions of "mansion tax" proposals aren't why the state is short of housing and why housing prices have been rising so fast. While mansions typically occupy larger lots, Connecticut remains full of vacant land and, especially in its cities, decrepit former industrial and residential sites. The state has plenty of room for more housing. Land hogging by the wealthy is not getting in the way.

Connecticut's housing shortage has four major causes.

First is the soaring inflation of the last few years, engineered, in my view, by President Biden and Congress. This has driven up prices and mortgage rates far faster than the incomes of ordinary people. People who own residential and other substantial property, especially the wealthy, profit from inflation, but most others suffer from it.

Another cause is the flood of illegal immigration, a matter of Democratic Party policy on both the federal and state levels. It may be no coincidence that the number of illegal immigrants estimated to be living in Connecticut, more than 100,000, is close to the number of housing units the state is said to lack.

A cause of longer duration is exclusive zoning in suburbs and rural towns, zoning that discriminates against less expensive housing, particularly apartments and condominiums. Such zoning generally has community support, since most people don't want their neighborhoods to become more crowded, though of course their own arrival may have increased the neighborhood's population.

Exclusive zoning has its own cause. In some places exclusive zoning arose long ago from racism or ethnic or religious bigotry. But for many years now exclusive zoning has been sustained mainly by fear of poor people generally, a fear largely justified by the disaster inflicted on the cities, their residents, and everyone else by mistaken state and federal welfare and education policies. People don't want the pathologies of poverty -- fatherlessness, child neglect, crime, ignorance, indolence, and dependence -- imported into their neighborhoods by new housing accessible to the poor. This fear has produced zoning and community opposition that now often obstruct even middle-class, owner-occupied housing.

State government has responded with a law that weakens the use of exclusive zoning against housing, but it hasn't been very effective, and in any case inflation, declining real wages, and illegal immigration still stand in the way.

That's why that Washington "think tank" study on raising taxes on the sale of "mansions" and a similar proposal by state Senate President Martin M. Looney (D.-New Haven), to impose a punitive statewide property tax on "mansions" are so dishonest. While these ideas will raise money, there's no guarantee that much of it will be spent to build housing. More likely the money will be used as most extra tax revenue in Connecticut is used -- to pay the compensation of government's own employees, the Democratic Party's campaign army, while punitive taxes on "mansions" provide camouflage for the real objective.

Housing supply can be increased without punitive taxes on large homes -- by stopping inflation, enforcing immigration law, having state government cover all extra school and police costs of new housing, and revoking the welfare and education policies that manufacture poverty.

But that would take the fun out of blaming "mansions" for the declining living standards caused by elected officials who style themselves defenders of the poor even as they make poverty worse.

Chris Powell has written about Connecticut government and politics for many years (CPowell@cox.net).

Chris Powell: Conn. budget surplus the flip side of inflation

Price adjustment

— Photo by Jim.henderson

MANCHESTER, Conn.

Connecticut state government has had worse managers than Gov. Ned Lamont, but nobody should be much impressed by the huge financial surplus over which he is presiding -- more than $4 billion, equivalent to a fifth of state government's annual budget.

For the surplus is not a product of any astounding new efficiencies in state government achieved by the Lamont administration.

No, state government still spends more every year without any marked improvement in service to the public or the state's living standards.

Instead the surplus arises from billions of dollars in emergency cash from the federal government, distributed in the name of relief from the recent virus epidemic, and from big increases in state capital gains tax revenue.

Most state governments are enjoying big surpluses for the same reasons. But happy days are not really here again, for an old saying from Wall Street counsels caution: Don't mistake a bull market for genius.

Caution is especially advisable now because, on top of the termination of that emergency federal aid, the stock market has more often than not been falling for a few months and is no longer producing capital gains for people who, to get richer, had to do little more than hang around.

The capital gains on which they lately have been paying much more in state taxes are, along with all that federal money propping up the state's financial reserves, mainly the other side of the inflation that is devastating living standards throughout the country and the world.

The U.S. money supply, determined entirely by the federal government, is estimated to have increased by about 35 percent in the last three years even as the number of full-time workers fell, government paid people for not working, and production declined.

More money amid less production is the recipe for inflation, and perhaps not so coincidentally Connecticut state government's financial surplus of about 20 percent of the annual budget is closer to the real annual rate of inflation than the official rate misleadingly calculated by the government, which lately has been about 9 percent.

State government's financial position may look great but it has come at a great cost. Government has saved itself but not the people.

xxx

Connecticut's buzz word of the moment seems to be "equity." It sanitizes almost anything, including the state-licensed growing and retailing of marijuana. Under Connecticut's new marijuana-legalization program, licenses are to be required for large-scale growing of marijuana and to be limited to companies involving people from areas that saw a high level of prosecutions in the "war on drugs."

People who obeyed the drug laws will get no such privileges for their good citizenship.

In essence marijuana licenses are becoming political patronage. Meeting clear criteria won't be enough. The state Consumer Protection Department will award licenses not just according to the criteria but also as favoritism.

So it's not surprising that, as the Connecticut Examiner reported last week, a grower's license is likely to be awarded to a company owned in part by former state Sen. Art Linares, a Republican married to Stamford Mayor Caroline Simmons, a Democrat and former state representative.

That's called working both sides of the street.

According to the Examiner, the "equity" part of Linares's application is a partner who "has lived for five of the last 10 years in a disproportionately impacted area of Connecticut."

That is, a front man. How just and remedial!

All this evokes how Connecticut handled the start of cable television 50 years ago. State law divided the state into franchise areas with a single license to be issued for each. To qualify, a company had to be owned by local residents. But they weren't required to have the capital and expertise needed to operate the business.

So local politically connected people started such companies, got the franchise license, and sold the franchise to a real cable TV company, making a bundle. This racket came to be called "rent a citizen."

Today's marijuana-licensing racket will enrich people who need only to be friends with someone who can pretend to have been oppressed.

Chris Powell is a columnist for the Journal Inquirer, in Manchester.

Tearing up

“Tears Along the Edge” (installation detail) (acrylic on cut and molded Tyvek), by Susan Emmerson, M.D., at Kingston Gallery, Boston, through Feb 2.

She explains on her Web site:

“My work is an exploration of the picture plane; it delves into that surface between wall and the environment and expands that surface for the viewer to follow. My drawings and paintings rise off the wall into three dimensions, forming shadows and caverns which in turn incorporate themselves into the the work itself. Using surfaces of paper, Tyvek (a plastic paper), and canvas I explore below these surfaces and expand them outward by heating, sanding, cutting, gluing and plastering and incorporating the structure into the imagery. I use unexpected materials to examine our emotional connection to both the external built environment and the internal environment of the human body.

“In my most recent body of work my imagery is that of creating and destroying; of depicting the horrible violence that natural storms, worsened by human mistakes, can do to our structural environment and to our fellow humans. My wall sculptures depict disheveled, broken surfaces where Tyvek painfully peels away like paint or skin, exposing a raw inner core. Everyday objects become precious; I use their bits and pieces as signifiers of the lost reassurance of a safe and intact home. I manipulate Tyvek so that it jumps off the wall to become an object; its organic shapes echo waves, wind, and the contortions of the earth as visits another storm on its human inhabitants. My work exists in the space between image and object; between the picture and the palpable.’’

Pot in the air

From Robert Whitcomb's "Digital Diary, in GoLocal24.com

As Rhode Island, Massachusetts and some other states (if not the Feds) loosen laws against marijuana cultivation and use, pot smokers are becoming increasingly noxious neighbors in apartment and condo buildings. I have noticed the rich aroma of the stuff in some buildings and certainly on many sidewalks.

Reminder: Marijuana cultivation, sale and use are still prohibited under federal law, which presents considerable confusion in states that allow sale and use of the stuff anyway. The Feds have long looked the other way on this, fearing that the federal law is just too difficult to enforce, considering some states’ policies and that millions of people regularly smoke pot.

Non-pot smokers are being forced to inhale this psychotropic smoke, which, to say the least, is unhealthy. Of course, breathing second-hand tobacco smoke is bad for you, too, but it doesn’t affect your clarity of mind as marijuana smoke does. In some places, you can become involuntarily intoxicated.

Pot has become such a big business and tax-revenue supplier that, barring rigorous enforcement of federal laws still on the books, the problem of second-hand smoke can only get worse. And I laugh at the argument that states’ effective legalization of the weed primarily serves as a way to alleviate physical pain. Most people smoking pot just want to get mildly or very stoned for the pleasure of it, and there’s much profit and tax money to be made from the stuff.

To read an entertaining Boston Globe story on second-hand pot smoke, please hit this link.