Omar Ocampo: Extreme wealth inequality means extreme political inequality

—Photo by ThirstyFish.com

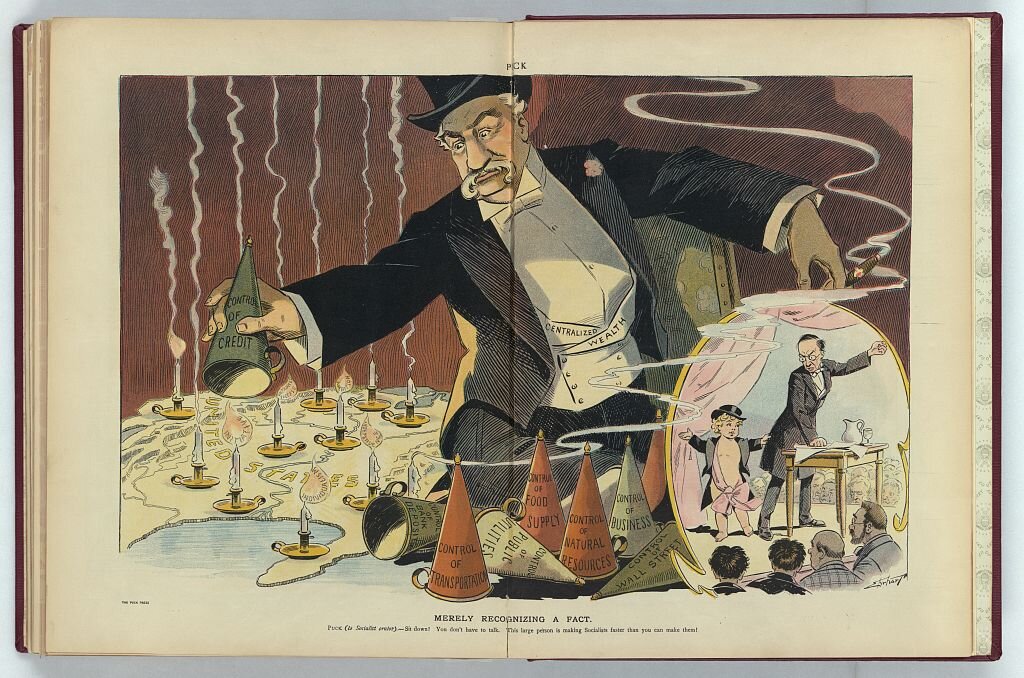

Progressive era cartoon

Via OtherWords.org

BOSTON

A new, disturbing milestone has been confirmed in the latest Forbes World Billionaires List. The U.S. billionaire class is now larger and richer than ever, with 813 ten-figure oligarchs together holding $5.7 trillion.

This is a $1.2 trillion increase from the year before — and a gargantuan $2.7 trillion increase since March 2020.

The staggering upsurge shows how our economy primarily benefits the wealthy, rather than the ordinary working people who produce their wealth. Even worse, those extremely wealthy individuals often use these assets to undermine our democracy.

Billionaires have enormous power to influence the political process. They spent $1.2 billion in the 2020 general election and more than $880 million in the 2022 midterms. Even when their preferred candidates aren’t in office, our institutions are still more likely to respond to their policy preferences than the average voter’s, especially when it comes to taxes.

The vast majority of Americans, including 63 percent of Republicans, support higher taxes on the wealthy. Yet our representatives consistently fail to deliver. A quintessential example was Donald Trump’s 2017 tax cuts for corporations and the rich — the most unpopular legislation signed into law in the past 25 years.

Though backers promised the tax cuts would benefit all Americans, a recent report by the Center on Budget and Policy Priorities revealed that the primary beneficiaries were the top 1 percent.

The good news? Those cuts are set to expire after next year. So we’ll have an opportunity for a new tax reform — one that raises more money for the services we rely on while protecting our democracy from extreme wealth concentration.

President Joe Biden’s Billionaire Minimum Income Tax (BMIT) is one promising proposal. By raising the top tax rate and taxing unrealized capital gains, the BMIT seeks to repair a system where billionaires pay a lower average tax rate than working people. It would raise $50 billion a year over the next decade, making our tax system a bit more equitable.

Senator Ron Wyden’s (D.-Ore.) similarly named Billionaire Income Tax (BIT) is more straightforward. It would target asset gains that can easily be tracked by the public, like a billionaire’s stock holdings in a publicly traded company.

Another idea? A well-designed progressive tax on billionaire wealth.

A modest 5 percent tax on all wealth above $1 billion would raise more than $244 billion this year alone. And that’s likely an underestimate, since some billionaires keep their wealth concealed from Forbes. Wealth-X, a private research firm, identified 955 billionaires in their Census last year, 142 more than what Forbes just registered.

A wealth tax wouldn’t hurt investment and innovation — most innovation in the U.S. is driven by people worth less than $50 million. But for billionaires, it would function “as a constraint on their rate of wealth accumulation,” according to Patriotic Millionaires, a group of wealthy people who support higher taxes on the rich.

Of course, a wealth tax alone isn’t enough to ensure the safety of our democracy. We also need campaign finance reform to limit political spending. And stronger labor unions could prevent extreme concentrations of wealth from occurring in the first place. Unions not only increase the collective power of workers, they also close wage gaps between workers and CEOs.

Finally, we need better tax enforcement. The Inflation Reduction Act gave the IRS more resources to track down wealthy tax dodgers, and now the agency is projecting an unexpected windfall in tax revenue over the next decade.

That’s a great first step towards strengthening our democracy and democratizing our economy. Now let’s take the next step and fix the tax code itself.

Boston-based Omar Ocampo is a researcher for the Program on Inequality and the Common Good at the Institute for Policy Studies.

Jim Hightower: No, we're not 'all in this together'

Via OtherWords.org

In this horrible time of economic collapse, it is truly touching to see so many corporate chieftains reaching out in solidarity with the hard-hit working class.

We know they’re doing this because they keep telling us they are. Practically every brand-name giant has been spending millions of dollars on PR campaigns in recent weeks asserting that they’re standing with us, declaring over and over: “We’re all in this together.”

Except, of course, they’re really not standing anywhere near us. While we’re waiting in endless lines at food banks and unemployment offices, the elites are still getting fat paychecks and platinum-level health care.

The severity and gross disparity of our country’s present economic collapse is not simply caused by a sudden viral outbreak, but by a decades-long plutocratic policy of intentionally maximizing profits for the rich and minimizing everyone else’s wellbeing. As the eminent economist Joseph Stiglitz rightly put it, “We built an economy with no shock absorbers.”

Jobs, once the measure of a family’s economic security, have steadily been shriveled to low-wage unreliable work, untethered to a fair share (or any share) of the new wealth that workers create. In a relentless push for exorbitant, short-term profits, today’s executives have abandoned any pretense that a corporation is a community of interdependent interests striving to advance the common good.

Instead, while the honchos are richly covered, they’re washing their hands of any responsibility for the health, retirement, and other essential needs of their workforce. “Rely on food stamps, Obamacare, and other publicly-funded programs,” they say, even as their lobbyists and for-sale lawmakers slash the public safety nets so rich shareholders and speculators can take evermore profit.

These forces of American greed have shoved millions of working families to the economic precipice — and all it takes is a virus to push them over.

OtherWords columnist Jim Hightower is a radio commentator, writer and public speaker.

Sam Pizzigati: Inequality of life expectancy exploding in the U.S.

Via OtherWords.org

BOSTON

What do the folks at the U.S. Census Bureau do between the census they run every 10 years? All sorts of annual surveys, on everything from housing costs to retail sales.

The most depressing of these — at least this century — may be the sampling that looks at the incomes average Americans are earning.

The latest Census Bureau income stats, released in mid-September, show that most Americans are running on a treadmill, getting nowhere fast. The nation’s median households pocketed 2.3 percent fewer real dollars in 2018 than they earned in 2000.

America’s most affluent households have no such problem. Real incomes for the nation’s top 5 percent of earners have increased 13 percent since 2000, to an average $416,520.

The new Census numbers don’t tell us how much our top 1 percent is pulling down. But IRS tax return data shows that top 1 percenters are now pulling down over 20 percent of all household income — essentially triple their share from a half-century ago.

Should we care about any of this? Is increasing income at the top having an impact on ordinary Americans? You could say so, suggests a just-released Government Accountability Office study.

Rising inequality, this federal study makes clear, is killing us. Literally.

The disturbing new GAO research tracks how life has played out for Americans who happened to be between the ages of 51 and 61 in 1992. That cohort’s wealthiest 20 percent turned out to do fairly well. Over three-quarters of them — 75.5 percent — went on to find themselves still alive and kicking in 2014, the most recent year with full stats available.

At the other end of the economic spectrum, it’s a different story.

Among Americans in the poorest 20 percent of this age group, under half — 47.6 percent — were still waking up every morning in 2014. In other words, the poorest of the Americans the GAO studied had just a 50-50 chance of living into 2014. The most affluent had a three-in-four chance.

“The inequality of life expectancy,” as economist Gabriel Zucman puts it, “is exploding in the U.S.”

The new GAO numbers ought to surprise no one. Over recent decades, a steady stream of studies have shown consistent links between rising inequality and shorter lifespans

The trends we see in the United States reflect similar dynamics worldwide, wherever income and wealth are concentrating. The more unequal a society becomes, the less healthy the society.

On the other hand, the nations with the narrowest gaps between rich and poor turn out to have the longest lifespans.

And the people living shorter lives don’t just include poorer people. Middle-income people in deeply unequal societies live shorter lives than middle-income people in more equal societies.

What can explain how inequality makes this deadly impact? We don’t know for sure. But many epidemiologists — scientists who study the health of populations — point to the greater levels of stress in deeply unequal societies. That stress wears down our immune systems and leaves us more vulnerable to a wide variety of medical maladies.

We have, of course, no pill we can take to eliminate inequality. But we can fight for public policies that more equally distribute America’s income and wealth. Other nations have figured out how to better share the wealth. Why can’t we?

Sam Pizzigati, based in Boston, co-edits Inequality.org for the Institute for Policy Studies. His latest book is The Case for a Maximum Wage.