Chris Powell: Government employees above the law in Conn.

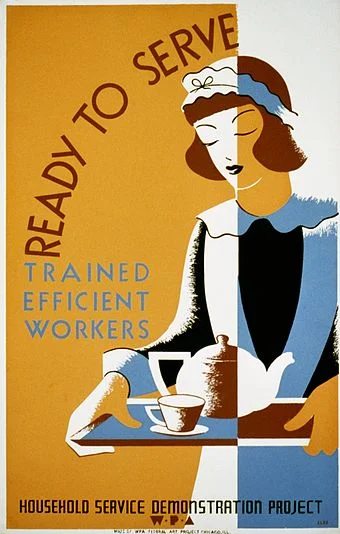

Not always? WPA poster from the Great Depression.

What happens when someone asserts that the compensation of members of state and municipal government employee unions, being the biggest expense of government in Connecticut, should be determined through the ordinary democratic process and not through secret negotiations between unions and politicians or by the decisions of unelected arbiters who answer to no one?

When that happens the unions shriek: You hate working people!

What happens when an academic study concludes that the compensation of Connecticut's state and municipal government employees is far more generous than that of most states because it is determined by a system that puts the government employee unions above the law?

The political allies of those unions, like state Senate's Democratic leader, Bob Duff of Norwalk, let loose the same shriek: You hate working people!

Such a study was published the other day by the Yankee Institute for Public Policy and Duff accused it of trying to "dismantle the middle class for the oligarchy" and to create an economy "where everyone works for a minimum wage."

Of course this shrieking fails to addresses the issues being raised. It aims to prevent those issues from being addressed. But thanks to the Yankee Institute study, at least those issues now are in the spotlight.

The study, "Above the Law," by Priya Abraham Brannick of the Pennsylvania-based Commonwealth Foundation for Public Policy Alternatives and F. Vincent Vernuccio of the Mackinac Center for Public Policy, in Michigan, is indisputable in its basic points:

-- Connecticut law subjects to collective bargaining more of the compensation and working conditions of state and municipal employees than most other states do.

-- Binding arbitration of state and municipal employee union contracts in Connecticut prevents elected officials from exercising much authority over the terms of government employment. Indeed, that is the very point of binding arbitration: to diminish the authority of elected officials.

-- Connecticut law even allows state and municipal employee union contracts to take precedence over state law. For example, while ordinarily the disciplinary records of government employees are public records, union contracts can nullify the public's right to know so misconduct and incompetence on the public payroll can be concealed.

Nobody should feel sorry for Connecticut's elected officials because of this. They don't want authority over the biggest costs of government. They don't want to get caught between taxpayers and the government employee unions. As employee compensation cannibalizes the government, Connecticut's elected officials want to be able to shrug and say they can't do anything about it, though this inability to control the costs of government employment is a primary driver of the state's disastrous decline.

Democratic elected officials especially don't want the government to regain control of its employment costs, because their party is dominated by the government employee unions.

But collective bargaining for government employees and binding arbitration of their union contracts should be repealed because they destroy democracy and their premise is that the only working people are those on government's payroll, that people who merely pay taxes are properly slaves.

So why do Connecticut's government employee unions hate taxpayers so?

Chris Powell is a columnist for the Journal Inquirer in Manchester, Conn., and a frequent contributor to New England Diary.

Don Pesci: Lessons for the wise men of Connecticut

VERNON, Conn.

In most fairy tales, the way out of the dark forest is the way in -- in reverse. Sometimes the hero of the story will take care when entering the bewildering forest to lay out the way back by leaving behind markers, beans strewn on the ground, so he will not forget the entrance and exit routes. The moral of all these tales is the same: if you’ve make a mistake, reverse your errors. It is a lesson politicians in Connecticut might take to heart. With a little courage and the virtue of foresight, the lucidity of remembrance brought to bear on current difficulties, there is no difficulty that cannot be overcome.

In a recent piece in National Review, senior fellow at the Manhattan Institute Stephen Eide gives us a summary view of Connecticut’s weaknesses. The top marginal income-tax rate in Connecticut now stands at 6.99 percent, Eide writes, “almost two points higher than the 5.1 percent in neighboring Massachusetts. The income tax has generated a flood of new revenues — $126 billion over 25 years, according to the Hartford-based Yankee Institute for Public Policy — but somehow state lawmakers neglected to direct adequate funds to the pension system. As a consequence, Connecticut’s state employees’ retirement system is funded at only 35.5 percent, one of lowest rates in the nation. Despite a slew of recent tax increases, state government now faces deficits of $1.5 and $1.6 billion in the next two fiscal years.”

Such is Connecticut’s forest, dark and dank. As grown-ups, we should candidly admit that marginal tax rates do not increase automatically; they are raised over time by people who do not perceive the connection between high tax rates and diminishing revenues. President John Kennedy did understand the connection, which is why he proposed in a speech studiously ignored by Democratic progressives in Connecticut to reduce marginal tax rates for the express purpose of boosting federal revenue. His reductions fueled business expansion, which flooded federal coffers.

The flood of new tax revenue mentioned by Eide -- $126 billion over 25 years – was misused by politicians who chose not to “direct adequate funds to Connecticut’s pension system.” Connecticut now “faces deficits of $1.5 and $1.6 billion in the next two fiscal years” because spending has outstripped revenue collection, despite historically large tax increases. After the imposition of a state income tax in 1991, after Gov. Dannel Malloy imposed on Connecticut both the largest and the second largest tax increases in state history, deficits continue to pile up – because spending follows in the wake oftax increases: the more you get, the more you spend. So, where’s the exit?

It should not take the wise men of Gotham to propose the proper remedy for what ails us – cut spending, “a thing easy to say, but hard to do,” as the fairy tales continually remind us. It turns out in the fairy tales that the wise men of Gotham sometimes come up short on sensible solutions. Having decided to raise money by establishing two ponds and filling both with sell-able fish, the wise men of Gotham one day discover that a large eel had ravaged one of the ponds.

“A mischief on this eel, for he has eaten up all our fish. What shall we do with him?”

The wise men take council with each other. One says, “Kill him!” Another advises, “Chop him into pieces.” A third says, “No so. Let’s drown him!” All say, “Be it so!” And with that the eel is taken from the pond where he has eaten all the fish and thrown into the second pond full of fish, where he is left, so the wise men of Gotham think, to drown. This is not, wise men of Connecticut will agree, a fit solution to the problem.

For a quarter century, Connecticut politicians, mostly progressive Democrats tied to the iron apron strings of state employee unions, have been throwing the eel back into the fish pond, thinking in this way they might drown the troubles of the state. It hasn’t worked, it cannot work, it will not work. Following the imposition of the Lowell P. Weicker income tax in 1991 and Malloy’s two crippling income taxes increases –tax increases that have twice prolonged national recessions and offered irresistible inducements to boost spending – our state, somewhat like Malloy’s approval ratings, is scraping the bottom of an empty barrel. And there is little indication that Malloy or other Democratic progressives, operating from a failed economic model, have even bothered to read the writing on the wall, which plainly calls for permanent tax and spending reforms.

Don Pesci is a Vernon, Conn.-based political writer.