Watch where you step

“Untitled (Face in Dirt)” (pigmented ink print), by David Wojnarowicz (1954-1992) in the show “Come Closer: Selections From the Collection, 1978-1994,’’ at Colby College Museum of Art, Waterville, Maine

The museum explains that “Come Closer” “presents artworks … that explore the relationship between the personal and the political. During this period, artists reflected upon urgent current events and social issues such as gender equality, racial justice, technological advancements, sexual freedom, and the AIDS crisis.”

Ready for a fight

“Costume Design” (1924) (graphite and gouache on paper), by Alexandra Exter, in the show “Time and Tide Flow Wide: The Collection in Context, 1959-1973,’’ at the Colby Museum of Art, Waterville, Maine. The exhibition celebrates the early years of the museum.

Dressed up for the end

“Dr. Syn” (tempera on panel), by Andrew Wyeth, in the show “Andrew Wyeth: Life and Death,’’ at the Colby College Museum of Art, Waterville, Maine, through Oct. 16.

The museum says that famed painter Wyeth (1917-2009) envisions his own funeral in the recently rediscovered series of drawings from the 1990s. "The exhibition connects the sketches now known as the Funeral Group to Wyeth’s decades-long engagement with death as an artistic subject in painting, his relationships with the models depicted, and his expressive and exploratory use of drawing." Wyeth lived on the Maine Coast for much of his life.

About the title: The Reverend Doctor Christopher Syn is the smuggler hero of a series of novels by Russell Thorndike. The first book, Doctor Syn: A Tale of the Romney Marsh, was published in 1915. The story idea came from smuggling in the 18th-century Romney Marsh, in England, where brandy and tobacco were brought in at night by boat from France to avoid taxes.

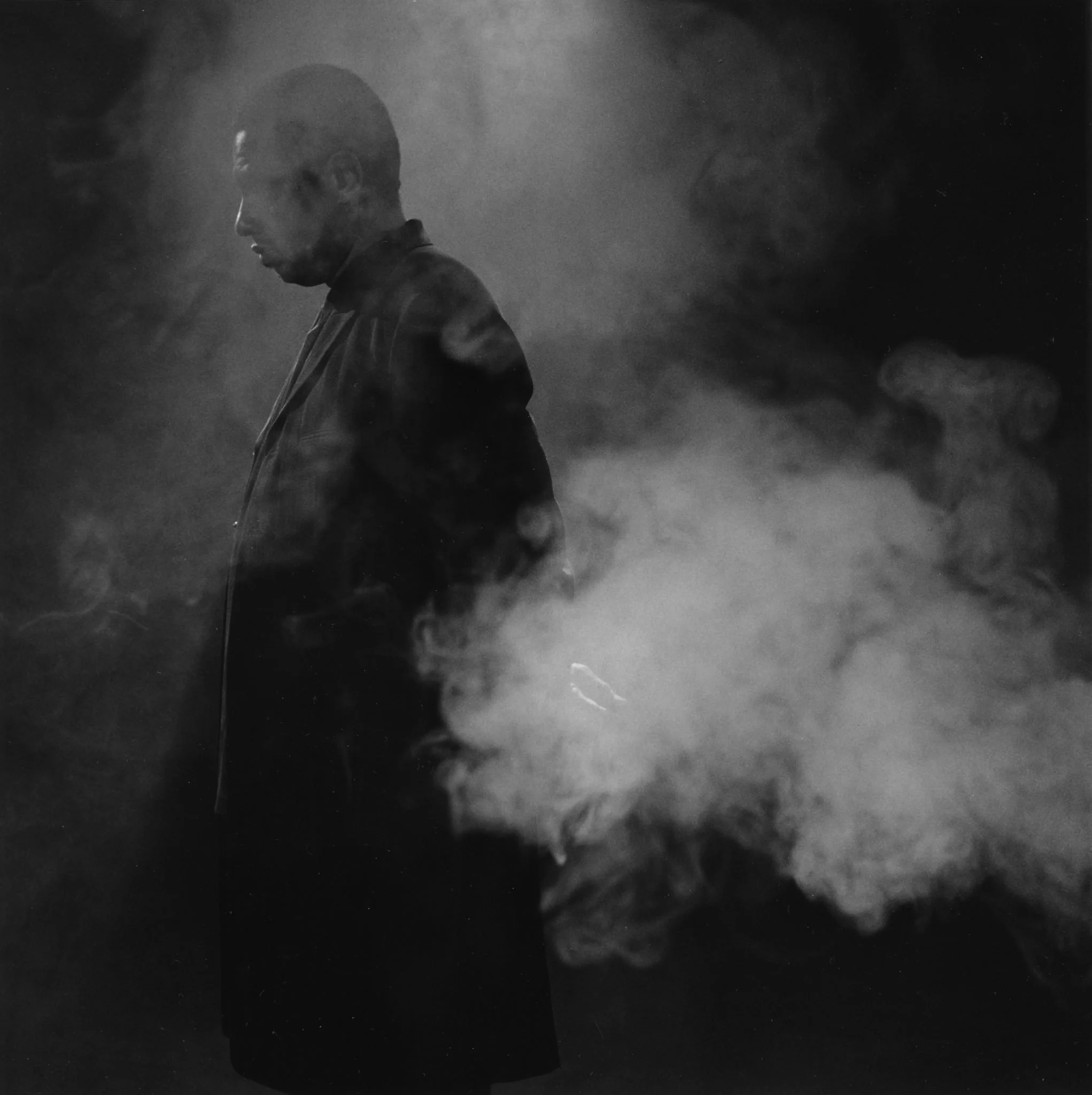

Cloudy at Colby

“Cloudscape’’ (still, video, sound), by Lorna Simpson, in the show “The Poetics of Atmosphere: Lorna Simpson’s ‘Cloudscape’ and Other Works from The Collection,’’ at the (surprisingly large) Colby College Museum, Waterville, Maine, Feb 3.-April 17.

The museum says:

“Simpson’s work examines how identity, specifically Black identity, is formed, perceived, and experienced. ‘Cloudscape’ features a singular figure, the artist Terry Adkins, whistling as he is slowly engulfed in clouds. His seeming ability to fade—to appear ethereal, even to disappear—evokes the ways that race and gender inform a person’s capacity, or lack thereof, to determine their desired level of public visibility. ‘Cloudscape’ makes Adkins an apparition, more spirit than body, while distorting the viewer’s temporal and spatial understanding of the world within the video.

‘‘The artworks accompanying ‘Cloudscape’ allude to atmospheric conditions while also reflecting individualized articulations of weight. They challenge, and even circumvent, the embodied ways that we relate to our surroundings.’’

Uncooperative deity

“Ancient of Days,’’ by William Blake, 1794

“Although he’s regularly asked to do so, God does not take sides in American politics.’’

— George J. Mitchell (born 1933), former U.S. senator (and majority leader) from Maine, diplomat, federal judge and author. He was born and raised in Waterville, Maine, a former manufacturing town (e.g., Hathaway Shirts) now best known as the home of Colby College. Mr. Mitchell himself graduated from Bowdoin College, in Brunswick, Maine.

Waterville City Hall and Opera House in 1905, when the city was a thriving manufacturing center.

Ed Cervone: How a Maine college has adjusted to pandemic and recession

From The New England Journal of Higher Education, a service of The New England Board of Higher Education (nebhe.org)

In October 2019, NEBHE called together a group of economists and higher education leaders for a meeting at the Federal Reserve Bank of Boston to discuss the future of higher education (Preparing for Another Recession?). No one suspected that just months later, a global pandemic would turn the world upside down. Today, the same challenges highlighted at the meeting persist. The pandemic has only amplified the situation and accelerated the timeline. It also has forced the hands of institutions to advance some of the changes that will sustain higher education institutions through this crisis and beyond.

At the October 2019 meeting, the panelists identified the primary challenges facing colleges and universities: a declining pool of traditional-aged students, mounting student debt, increasing student-loan-default rates and growing income inequality.

Taken together, these trends were creating a perfect storm, simultaneously putting a college education out of reach for more and more students and forcing some New England higher-education institutions to close or merge with other institutions. Those trends were expected to continue.

Just three months later, COVID-19 had begun spreading across the U.S., and the education system had to shut down in-person learning. Students returned home to finish the semester. Higher-education institutions were forced to go fully remote in a matter of weeks. Institutions struggled to deliver content and keep students engaged. Inequities across the system were accentuated, as many students faced connectivity obstacles. Households felt the economic crunch as the unemployment rate increased sharply.

By summer, the pandemic was in full swing. Higher-education institutions looked to the fall. They had to convince students and their families that it would be safe to return to campus in an uncertain and potentially dangerous environment. Safety measures introduced new budgetary challenges: physical infrastructure upgrades, PPE and the development of screening and testing regimens.

In the fall, students resumed their education through combinations of remote and in-person instruction. Activities and engagement looked very different due to health and safety protocols. Many institutions experienced a larger than usual summer melt due to concerns from students and families about COVID and the college experience.

Despite these added challenges, New England higher-education institutions have adapted to keep students engaged in their education, but are running on small margins and expending unbudgeted funds to continue operations during the public-health crisis. Recruiting the next class of students is proving to be a challenge. The shrinking pool of recruits will contract even more and reaching them is much more difficult. Many low- and moderate-income families will find accessing higher education even harder and may choose to defer postsecondary learning.

Change is difficult but a crisis can provide necessary motivation. Maine institutions are using this opportunity to make the changes needed to address the current crisis that will also set them on a more sustainable path over the long term. Maine has a competitive advantage relative to the nation. A low-density rural setting and the comprehensive public-health response from Gov. Janet Mills have kept the overall incidence rate down. Public and private higher-education institutions coordinated their response, developed a set of protocols for resuming in-person education that were reviewed by the governor and public health officials, and successfully returned to in-person education in the fall.

In addition, Mills established the Economic Recovery Committee in May and charged the panel with identifying actions and investments that would be necessary to get the Maine economy back on track. This public process has reinforced the critical ties between education and a healthy economy. Not only is higher education a focus of the work, but the governor appointed Thomas College President Laurie Lachance to co-chair the effort. In addition, the governor appointed University of New England (in Biddeford, Maine) President James Herbert, University of Maine at Augusta President Rebecca Wyke, and Southern Maine Community College President Joseph Cassidy to serve on the committee.

At the individual institution level, a wide array of innovations will enable Thomas College to endure the pandemic and position itself for the future. Consider:

Affordability. Most Thomas College students come from low- to medium-income households and are the first in their families to attend college, so-called “first-generation” students. Cost will always be top of mind. For motivated students, Thomas has an accelerated pathway that allows students to earn their bachelor’s degree in three years (sometimes two) and they have the option of doing a plus-one to earn their master’s. This, coupled with generous merit scholarship packages (up to $72,000 of scholarship over four years) and a significant transition to Open Educational Resources to reduce book costs, represents real savings and the opportunity to be earning sooner than their peers.

Student success supports. Accelerated programs (or any program, for that matter) are not viable without purposeful strategies to keep students on track to complete based on their plans. In addition to a traditional array of academic and financial supports, Thomas College has invested in a true wraparound offering serving the whole student. For eligible students, Thomas has a dedicated TRIO Student Support Services program. Funded through a U.S. Department of Education grant, the program provides academic and personal support to students who are first-generation, are from families of modest incomes, or who have an identified disability. The benefits include individualized academic coaching, financial literacy development and college planning support for families. Thomas was also first in the nation to have a College Success program through JMG (Maine’s Jobs for America’s Graduates affiliate). Thomas College has expanded physical- and mental- health services in the wake of the pandemic, including our innovative Get Out And Live program, which uses Maine’s vast natural setting to provide a range of exciting four-season, outdoor activities for the whole campus community.

Employability. Thomas College students see preparing for a rewarding career as part of their college experience. This is core to the college’s mission and more important than ever in an uncertain economic environment. It is so important that it is guaranteed through the college’s Guaranteed Job Program. Thomas College’s Centers of Innovation focus on the employability of each student. Students pursue a core academic experience in their chosen field, and staff work with each student starting in their first semester to increase their professional and career development. This means field experiences and internships with Maine’s top employers. About 75 percent of Thomas College students have an internship before graduation. As part of their college experience, Thomas College students are coached to earn professional certificates, licenses and digital badges prior to graduation that make them stand out in their professional fields and improve their earning potential. These might include certificates in specific sectors like accounting and real estate or digital badges that show proficiency in professional skills like Design Thinking or Project Management, to name just a few. On the academic side, Thomas has expanded both undergraduate and graduate degree offerings to programs where the market has great demand, including Cybersecurity, Business Analytics, Applied Math, Project Management and Digital Media. Delivery is flexible in terms of mode and timing. And the institution is now offering Certificates of Advance Study (15-credit programs) in Cybersecurity, Human Resource Management and Project Management to meet the stated needs of our business partners seeking to upskill their employees.

Looking Ahead

Some of these changes and investments align with challenges identified before the pandemic as necessary if higher education institutions are to survive and sustain changing demographic and economic trends. The pandemic provided the opportunity to focus on these more quickly, allowing institutions such as Thomas College to right the ship today and set the right course for tomorrow.

Ed Cervone is vice president of innovative partnerships and the executive director of the Center for Innovation in Education at Thomas College, in Waterville, Maine., also the home of Colby College.

Q&A on saving students money via OER

From The New England Journal of Higher Education, a service of The New England Board of Higher Education (NEBHE)

BOSTON

In the following Q&A, NEBHE Fellow for Open Education Lindsey Gumb asks Thomas College Provost Thomas Edwards about the Waterville, Maine, college’s plans to use a new grant from the Davis Education Foundation. The college’s focus on melding access and affordability through OER (Open Educational Resources) is especially relevant in the current shift to online learning at many campuses.

Founded in 1894, Thomas College offers undergraduate and graduate degrees in programs ranging from business, entrepreneurship and technology, to education, criminal justice and psychology.

Six in 10 students at the Waterville, Maine-based institution are “first-generation” college-goers who come from modest means. Thomas is a pioneer in so-called “job guarantees,” in which the college will make payments on federally subsidized student loans or provide tuition-free evening graduate courses for students who are unemployed at six months after graduation. Recently, Thomas added to its “employability” menu a master’s degree in cybersecurity, a co-curricular transcript that allows students to flaunt their leadership development, community service, internship and job shadow experience, and even a golf-readiness program given the student body’s relatively humble roots and how much career networking occurs on the links. Thomas President Laurie Lachance served as a member of NEBHE’s Commission on Higher Education & Employability and as a panelist on NEBHE’s 2019 roundtable on “The Future of Higher Education and the Economy: Lessons Learned from the Last Recession.”

In January 2018, Thomas College received a grant from the Davis Educational Foundation to redesign 30 courses over three years to help save students money on textbook costs—a well-documented and significant barrier to student success. To illustrate, a 2018 survey of Florida’s higher education institutions shows that 64% of students aren’t purchasing the required textbook for their courses because of the high cost, 43% are taking fewer courses, and 36% are earning a poor grade just because they were unable to afford the book. A 2018 study out of the University of Georgia by Colvard, Watson & Park additionally shows that OER goes beyond addressing affordability: OER enables increased learning and completion rates, while also addressing achievement gap concerns for historically underserved groups of students.

Here, Thomas Edwards, provost at Thomas College and member of NEBHE’s Open Education Advisory Committee, shares some insight into his institution’s progress with its Davis grant and how the results are increasing equitable attainment of a postsecondary education for Thomas students.

Gumb: The grant you received from the Davis Educational Foundation is helping Thomas College faculty convert 30 courses over three years using OER. What disciplines are represented in this mix? What does progress look like two years in?

Edwards: From the beginning, we recognized that there were two key goals of the Davis Educational Foundation grant. The first was student success, especially as it is tied to finances. We’ve been able to bring costs down dramatically for students—we had one course that went from a $253 textbook to no cost for students using OER. That’s a real savings for our students.

The second goal is pedagogical. Reworking a course to rely on OER is time-consuming but rewarding. It allows a faculty member to incorporate current materials and to design a course that mirrors the real-world environment: locating sources, analyzing data, communicating and working with real-time information.

To date, we’ve had faculty from across the disciplines participate: science, criminal justice, political science, education, economics, history, psychology, marketing, business finance and philosophy. We have been able to document thousands of dollars in savings to students. Students also report high satisfaction rates—91% indicate that they positively benefited from OER. Student performance as measured by grade distribution shows no statistically significant difference between OER and non-OER versions of the same course. It’s been a win-win across the board for students, faculty and the teaching and learning environment.

Gumb: Thomas College is regionally ranked #8 for social mobility by U.S News & World Report. How has OER played a role in positioning your institution for this achievement?

Edwards: We wanted to use OER to address both access and affordability. If a student can’t afford a book, if they add a course late, or if they have to wait until their financial aid comes in before they can purchase a text, they are already disadvantaged and potentially disengaged from a course. We don’t want them to fall behind.

We very intentionally focused the first courses that we redesigned on those entry-level courses that enroll higher numbers of students. We wanted to have an impact on student engagement and retention. Our success in social mobility is tied to our ability to help students make progress to their degrees.

We want students to be positioned for success. We want students and faculty to have the tools they need at their disposal from day one. That’s simply not the case when dealing with traditional texts. More than half of our students have reported that there have been times when they couldn’t afford the text. They also report that OER materials are more engaging than traditional textbooks. OER eliminates those barriers—motivational and financial. Students can focus on learning, faculty can focus on teaching … and the materials they need are right there for everyone to access.

Gumb: What kind of feedback have you received from your students?

Edwards: Students have embraced OER. Finances are one of the first things they notice. One student commented that “OER benefited my wallet.” But students also notice other aspects of course design. They comment that OER courses seem timelier and more relevant. They find OER courses to be more creative in presenting information. And here’s an interesting perspective: Students observe that because OER materials come from a variety of sources, they find less bias and subjectivity because the materials are more current and are updated more frequently. If we want our students to be information-literate, OER-based courses are one important way to get there.

Gumb: What has the faculty response looked like? Is participation mandatory, and if not, how are you incentivizing participation?

Edwards: Faculty response has also been very positive. Because we are talking about course redesign, we identified participation we wanted to encourage, but not mandate. We wanted to use the grant to demonstrate the benefits to both students and faculty and to encourage progress on both the financial and pedagogical fronts. The Davis Educational Foundation allowed us to provide an incentive through a stipend or a course release for faculty to work together on their redesign. Each semester, we have five slots open for faculty to propose a course. They work together as a cohort, sharing what works and what issues they are encountering.

Many people think that OER is about finding the right online version of a textbook, but it’s much more complex than that. The faculty workgroups spend their time discussing pedagogy and course design.

How do we encourage students to read critically? To engage? To interact? How do we structure assessment? What kinds of activities help build real learning? These are the conversations that bring other faculty into the mix, to encourage them to consider their own courses and how they might adapt. Our faculty report feeling more energized about their course revisions. They value the opportunity to work across disciplines and departments. And in the process, information and library services are integrated in more direct and meaningful ways with course design and delivery.

Gumb: OER are free for students, but they’re not free to create and maintain. How do you intend to address issues of sustainability when the grant money runs out?

Edwards: Sustainability is always a great question. We have engaged our librarian and Information Technology staff from the very beginning to work with the faculty, and they have now built up a great set of reference tools for anyone interested in adopting OER tools in their course design. We’ve involved our Faculty Development committee as well and highlighted at Faculty Senate meetings how OER can be effective for teaching and learning. We make the courses that have been redesigned available for others to adapt or adopt.

It’s ultimately about building into the campus culture a recognition that we need to continue to be conscious about the choices we make as a faculty and how those choices can impact student learning and student success.

Gumb: What advice do you have for senior leaders at independent institutions who might be just starting out with OER initiatives?

Edwards: Our focus from the very beginning was to be explicit about our goals: We wanted to define this opportunity as pedagogical as well as financial. We wanted to be clear that these concepts can and should go hand in hand.

Everyone across the campus can agree on the centrality of student success. Focus on success and focus on student learning. Use data effectively and make sure you can measure your success. We have had faculty at the front and center of the project design and it has worked extremely well. Faculty want their students to learn. OER can help.

The art of saving seeds

Installation view of the show SEED-O-MATIC at the Colby College Museum of Art, Waterville, Maine, through May 8.

The museum (remarkably large for a small , if well-endowed, college), explains that the artists Emma Dorothy Conley and Halley Roberts created the show in conjunction with the Center for Genomic Gastronomy (CGG), which is dedicated to researching, prototyping and inspiring a "more just, biodiverse, and beautiful food system". As large agrochemical companies buy out seed suppliers and patent their genetic information agricultural biodiversity and food sovereignty are threatened.

Colby College Museum of Art

Photo by Colby Mariam

Waterville used to be a bustling factory town; now it’s best known for Colby. A Wikipedia entry notes:

“The Kennebec River and Messalonskee Stream provided water power for mills, including several sawmills, a gristmill, a sash and blind factory, a furniture factory, and a shovel handle factory. There was also a carriage and sleigh factory, boot shop, brickyard, and tannery. On Sept. 27, 1849, the Androscoggin and Kennebec Railroad opened to Waterville. It would become part of the Maine Central Railroad, which in 1870 established locomotive and car repair shops in the thriving mill town….

‘‘The Ticonic Water Power & Manufacturing Company was formed in 1866 and soon built a dam across the Kennebec. After a change of ownership in 1873, the company began construction on what would become the Lockwood Manufacturing Company, a cotton textile plant. A second mill was added, and by 1900 the firm dominated the riverfront and employed 1,300 workers. …. The iron Waterville-Winslow Footbridge opened in 1901, as a means for Waterville residents to commute to Winslow for work in the Hollingsworth & Whitney Co. and Wyandotte Worsted Co. mills, but in less than a year was carried away by the highest river level since 1832. Rebuilt in 1903, it would be called the Two Cent Bridge because of its toll. In 1902, the Beaux-Arts style City Hall and Opera House designed by George Gilman Adams was dedicated. In 2002, the C.F. Hathaway Company, one of the last remaining factories in the United States producing high-end dress shirts, was purchased by Warren Buffett's Berkshire Hathaway company and was closed after over 160 years of operation in the city….

“In 1813, the Maine Literary and Theological Institution was established. It would be renamed Waterville College in 1821, then Colby College in 1867. Thomas College was established in 1894. The Latin School was founded in 1820 to prepare students to attend Colby and other colleges, and was subsequently named Waterville Academy, Waterville Classical Institute, and Coburn Classical Institute.’’

One Post Office Square, a multiple-use facility, in downtown Waterville

John O. Harney: Are N.E. colleges ready for the next recession?

Maine Maritime Academy, in Castine, Maine. Its graduates incur high debt levels but have very low default rates.

From The New England Journal of Higher Education (NEJHE), a service of The New England Board of Higher Education (nebhe.org)

Times are already complex for higher education. In Massachusetts, 18 higher education institutions (HEIs) have closed or merged in the past five years. In Vermont, College of St. Joseph, Green Mountain College and Southern Vermont College all held their final graduation ceremonies in the spring. What would happen if a recession were to add to this uncertainty?

With that question in mind, NEBHE in mid-October convened a small group* of higher education leaders and economists to talk about “The Future of Higher Education and the Economy: Lessons Learned from the Last Recession.”

To be sure, some of the problems that have forced college closures are national, but New England (along with the rest of the Northeast and the Upper Midwest) faces specific challenges: most importantly, a daunting demography that spells trouble for college enrollments. By 2032, the number of new high school graduates in New England is projected to decline by 22,000 to a total 140,273, according to the Western Interstate Commission for Higher Education.

The NEBHE confab aimed to better understand the key challenges and consequences HEIs faced as a result of the so-called “Great Recession” and what can be learned from them. Among guiding questions:

What is the likely course of the economy over the next 18 to 24 months?

How prepared are institutions for the next recession?

What lessons did higher education learn from the Great Recession?

What conversations should HEIs—presidents, senior leaders, board leaders—be having now?

How fragile are higher ed institutions in New England and beyond?

What economic or other indicators should we be watching at this point in the economic cycle?

What’s the impact of reduced or stagnant state and federal government support?

How did the last recession impact families—and what does it mean for their ability to pay ever-increasing tuition and fees?

When another recession hits, are there adequate social safety nets to cushion the blow?

Which responses to changing demographics, customer preferences and new technology could help institutions avert closure … and even thrive?

The current state and future course of the economy

NEBHE President and CEO Michael K. Thomas opened the discussion asking for panelists’ perceptions of the state of the economy.

The U.S. has been enjoying the longest economic expansion in history. But looking worldwide, China’s economy is slowing, global manufacturing is suffering, and trading nations like Germany and Singapore are close to recession.

Nigel Gault, chief economist in the Boston office of EY-Parthenon, noted that the current expansion has been long (more than 10 years) but slow, not reaching 3% GDP growth in any year. Moreover, higher education enrollments have trended down while student loan debt has exploded. Tuition prices keep going up, raising increasing questions about whether the investment in higher education is worth it. And the demography will get even worse after 2025.

In addition, the international enrollment that kept some HEIs above water is under increased pressure. For international students, “it’s a combination of sensing they’re not wanted and facing more hurdles to get the necessary visa to come,” said Gault.

The overall result: fewer traditional-age college applicants.

“Back in the last expansion, enrollment was still growing 1 to 2%, which is not great, but this time, the expansion has been much slower overall, and enrollment growth is only half a percent to 1%,” said Thomas College President Laurie Lachance.

In her previous roles as the Maine state economist and as corporate economist at Central Maine Power Co., Lachance heard from businesses that bad economic policy is better than frequently changing policy. She wondered if the current whiplash of national policies could tip us into recession.

Gault shared the thought: “Bad policy and volatile policy is a toxic combination. Often the best thing for the economy is policy paralysis because people know the rules are going to stay as they are now and they can plan on that basis.”

What kind of recession?

Recessions can result from global market downturns or be sparked by outside geopolitical events such as the Gulf War in the early 1990s or the subprime mortgage crisis that began in 2007 and led to the 2008 Great Recession.

None of the panelists thought a 2008-magnitude recession would come soon. But Gault suggested the No. 1 risk is the intensification of trade wars between the U.S. and China or the U.S. and Europe. Gault added that China can no longer play the role of savior of the global economy as it did after the Great Recession.

Participants agreed that different kinds of HEIs would be hurt differently by different kinds of recessions. Not only would a recession caused by global downturn be very different from one caused by local or even institution-specific financial factors. At the family level, a recession centered around the financial sector would directly hit a different group of New Englanders than one centered on manufacturing recession.

The panelists imagined multiple scenarios. Some elite HEIs with significant endowments will be hurt for a short time with a market downturn, but they’ll be OK. Some state universities will be too big to fail. Some independent HEI leaders wonder if state governments will consider consolidating low-performing public campuses? If some public HEIs adopt free tuition models, their programs will be hard to resist for students whose parents lose their jobs in a recession. But a downturn would slow public investment in such programs.

If the past is a guide, any recession will bring some enrollment spurt, especially among older students because job options will be less plentiful, Gault observed. But unlike the tailwind during the Great Recession, the demographic headwind this time around, will probably result in a smaller enrollment spike. A modest recession that takes unemployment up to 6% could bring a less than 3% increase in annual enrollment, Gault said.

Even the recovery from the Great Recession varied by HEI based on the regions from which they drew students and whether their students were in programs that are cyclical or counter-cyclical, said University of Saint Joseph President Rhona Free. USJ’s latest focus has been nursing, teaching and social work, which were not especially hurt in 2008. The experience may have been different at liberal arts institutions that primarily offer disciplines, which in careerist times and places get reactions ranging from disparagement for having weak immediate career prospects to praise for being the key to critical thinking, noted Free, who was provost at Eastern Connecticut State University before joining USJ.

Endowment pressures

On average, 12% of operating budgets at HEIs are covered by endowments, though the figure at some wealthy institutions exceeds 50%, according to Timothy T. Yates, Jr., president and CEO of Commonfund Asset Management Company. He pointed out that most investment committees think of endowments by size, but the more important metric is how dependent institutions’ operating budgets are on endowment returns. He told of a private HEI where the share of operating budget covered by endowment went from 18% in 2008 to 15% in 2009. “That’s a huge hole in their operating budget and it took six years to recover.”

Moreover, most investment committees have not been happy with their recent return rates, Yates said. He explained that a market downturn on an endowment causes a drop in funding. HEIs generally draw about 5% from their endowments to support themselves. Yates said about 32% of HEIs have taken special-purpose appropriations from their endowments this year, up from 26% in 2017 and 18% in 2009. Some of these special appropriations have gone to marketing campaigns to drive enrollment; others have been aimed at addressing a deficit, Yates said.

“If people are drawing from their endowments with a one-time, one-year promise-we-won’t-do-it-again appropriation, I’m not sure that’s the way we should be operating. It’s potentially a Hail Mary activity.” said Susan Whealler Johnston, president and CEO of the National Association of College and University Business Officers (NACUBO).

Lachance saw all the high-finance handwringing as “first-world” problems. Her Thomas College, with just 800 undergraduates and a $13 million endowment, was on the brink of bankruptcy three decades ago. Now, the college, in the same Maine town, Waterville, as the richer Colby College (which has 2,000 undergraduates and an endowment of more than $800 million), makes tough business decisions to invest in only things that could lead to higher enrollment. Thomas draws just a few percentage points of its endowment annually for its operating budget.

Among new business models, Thomas College has added three-year degrees for high-performing high school students, and key employability programs such as a “golf guarantee” to make sure students, many the first in their families to attend college, graduate networking-ready and more familiar with practical realities of business leadership.

The demographic factor

In the 1970s and early ‘80s, when endowment values dropped sharply, high inflation exacerbated the problem, Yates said. But what higher ed had at that time was a big demographic tailwind with baby boomers starting to come into colleges. Baby boomers now represent about 25% of the population but nearly half of charitable giving.

Also in the ‘70s, higher ed saw the front end of more structured fundraising and the consolidation benefits of single-sex institutions merging. Plus, since there hadn’t yet been large tuition increases, there was room to fill classes with students who were willing to pay more. “In higher education, history has been kind to the continuation of bad business practices, for example, thinking you could just go on and on raising tuition,” Lachance said. But our expert panelists agreed that such slack was no longer in the system.

All in all, a lot of New England higher education’s fortunes can be tied to an aging population. Too few babies are being born to sustain our overbuilt higher education infrastructure. Adults, though underserved, are seen as possible saviors. Professors are aging too, and the older ones are less likely to buy into cost-saving technology and open-education resources that some HEIs such as Thomas College consider a key to success. College presidents, whose average tenure is less than seven years, and chief business officers are also heading toward a retirement cliff.

Johnston reflected on the challenges of HEI governance and added that a lot of board members are in their seventies and will be retiring soon. “Are they the big givers that institutions want to hold onto, or do we need new bring in younger, different thinkers?” Or is the best approach to encourage both, since senior trustees can help newer board members with the institutional context for board decision-making?

Young blood with a new perspective may also bring more honesty to boards. Roger Goodman of the Yuba Group and previously Moody’s (where he wrote for (NEJHE during the last recession) was surprised when a poll at a recent conference for higher education trustees showed nearly 65% believed their HEIs were on a solid financial footing. Such findings suggest a certain level of naivete or denial about the realities facing HEIs.

Then, there are questions about the whole higher education governance model. Board members’ connections to the world outside higher ed surely bring value. But does someone who’s made millions in private equity know the complexities of dealing with a shared governance model and the challenges of higher ed finances? And what about those trustees of public HEIs, some named to boards partly based on connections to governors and other appointing authorities?

Student loans and defaults

One of higher education’s biggest challenges is captured by a staggering number: $1.6 trillion. That’s the current total amount of student loan debt. And unlike other forms of consumer credit, student loan debt is only rising.

Phil Oliff noted that a fifth of federal loan borrowers are in default. There has been much discussion about how student loan debt itself may delay markers of adulthood such as buying a car or home, starting a family or starting a business. Default is an even bigger deal. Wages can be garnished. In some places, professional certifications can be stripped. And credit scores can be hit.

Notably and counterintuitively, the higher defaults are among students with low balances, often because they left college without completing a degree that would provide the earnings to repay their loans.

In Maine, not just community colleges but also lower-tiered university campuses, have higher default rates. Higher default rates seem to be more highly correlated with low graduation rates than they are with larger loan balances. For example, Maine Maritime graduates incur high debt levels but very low default rates, said Lachance.

Much was made of defaults among students at for-profit colleges. But enrollment at for-profits has plummeted since spiking around the time of the last recession.

Public investment in higher education

State funding of higher education has come back somewhat and state fiscal reserves have been built up since the Great Recession, said Oliff. But public higher ed gets disproportionately hit in recessions—as it is seen as a “balance wheel” for legislators struggling to write budgets during downturns.

In the last recession, Oliff added, the federal government created a specific pot of money for states to prop up budgets, plus policy decisions to increase the maximum Pell Grant award, veterans benefits and tax expenditures, such as credits for tuition and college savings incentives. The impact of the last recession, albeit significant, was softened by federal policy interventions. But there’s no guarantee that D.C. will act in the same way in the next recession.

The student debt issue also feeds into and grows out of the changing perceptions of the value of higher education. Increasing critiques of higher ed could affect the cyclical dynamic that has sent more students back to college during recessions. When a recession occurs, will some people question if investing in some or more higher education is a good strategy? Further, shorter-term credentials, rather than degrees, may be key in a changing economy, Gault said. Indeed, NEBHE and others increasingly focus on how “high-value” credentials can more efficiently prepare students for in-demand jobs than can full degree programs.

As an immigrant, USJ’s Rhona Free said she always saw “part of the American Dream is that your 18-year-old goes off to live on a campus and grows in many ways for four years, but the reality is that is largely a middle-class, upper-income, white American Dream. We have to innovate in getting all families to believe that this is achievable for their children and there’s a good return on investment. It will be less debt than if they bought a new car.”

Mergers and alliances

Johnston warned that presidents and boards should be talking about what alliances and mergers might mean to their institutions. But many do not want to talk about it, until they’re hard-pressed. Some of that is reflected in the sentiment noted by Goodman in which two-thirds of board members saw their HEIs as being on solid ground.

In addition, the process of mergers can put a lot of pressure on surviving HEIs. An institution facing the threat of closure might decide to get by for another year with an unsustainable discount, say 75%, to get the incremental student it wants. That can put a lot of pressure on other HEIs that are competing in the market. Johnston pointed out that one HEI in Virginia, determined to grow its enrollment, decided to go deeper into its waiting lists, which affected enrollments at competitors across the state, many of whom did not meet their revenue goals as a result.

“The business model isn’t working for us, and that requires innovation,” said Johnston. And it is explained poorly to the public and students with confounding concepts such as “tuition discounts” and “net prices vs. sticker prices.”

Students and families

When the discussion turned to the condition of social safety nets, Lachance lamented: “The rich are getting richer, the poor are getting poorer. When I was growing up, there were so many mills around us where a high school grad could do just fine. They’d get on a union wage scale and they had a great standard of living to send their own kids to college. Now it seems like the difference is based on your educational attainment. And if you don’t attend college and you don’t persist and graduate, you’ll never earn the return on that investment and you’ll be in debt.”

A recession will surely exacerbate the difference between those who have and those who have not, concluded Johnston. The question is not just which institutions will be most affected, but which students, for example, those with food insecurity. As President Free noted, HEIs’ food pantries and in-demand mental health services are now key social safety nets upon which many students already depend.

Moreover, “Kids who were watching their families go through the last recession may bring a separate set of anxieties with them if there’s another recession,” said Johnston. “They may dial back what they think they can do even if the circumstances don’t require it.”

John O. Harney is executive editor of The New England Journal of Higher Education.

* The panelists …

Rhona C. Free became the ninth president of the West Hartford, Conn.-based University of Saint Joseph in July 2015. During her time at USJ, she has championed the creation of the Women’s Leadership Center and guided the deliberations that led to the university’s decision to become fully coeducational in fall 2018. She joined USJ from Eastern Connecticut State University, where she served as vice president for academic affairs from 2007 to 2013 and provost from 2013 to 2015. She taught Economics at Eastern for 25 years before becoming an administrator.

Roger Goodman is a partner in the Boston office of The Yuba Group LLC, which provides independent financial advice and consulting to higher education institutions on debt and credit-related matters. Prior to joining the Yuba Group, he served as the team leader for the Higher Education and Not-for-Profit Team at Moody’s Investors Service, leading a team of 11 analysts responsible for credit analysis and credit ratings.

Nigel Gault is EY-Parthenon’s chief economist based in the Boston office. He was with Parthenon for a year before its combination with EY in August 2014. He advises clients on issues relating to their strategies, market growth and pricing. Gault was most recently chief U.S. economist at IHS Global Insight, where he was a seven-time winner of the Marketwatch Forecaster of the Month accolade for key economic indicators. He has also served as chief European economist in London for Standard & Poor’s/Data Resources and for Decision Economics.

Susan Whealler Johnston is president and CEO of the National Association of College and University Business Officers (NACUBO), a position she has held since Aug. 1, 2018. Prior to joining NACUBO, she was at the Association of Governing Boards of Universities and Colleges (AGB), where she served as executive vice president and chief operating officer, responsible for the day-to-day operations of the organization as well as strategic planning. Prior to joining AGB, she was professor of English and dean of academic development at Rockford University.

Laurie Lachance is Thomas College’s fifth president and the first female and alumna to lead the college in its 125-year history. From 2004 to 2012, she served as president and CEO of the Maine Development Foundation. Prior to MDF, she served three governors as the Maine state economist. Before joining state government, she served as the corporate economist at Central Maine Power Company.

Phillip Oliff is senior manager at The Pew Charitable Trusts in Washington, D.C., where he leads Pew’s work exploring the fiscal and policy relationships between the federal and state governments on a variety of topics, including how federal budget and tax changes could affect states, the role that federal and state finances play in higher education and surface transportation. He previously was a policy analyst at the Center on Budget and Policy Priorities, where he wrote reports on topics including education finance, state tax policy, states’ post-recession fiscal conditions and the impact of emergency federal aid on state budgets.

Timothy T. Yates, Jr. is president and CEO of Commonfund Asset Management and responsible for managing all aspects of Commonfund’s Outsourced Chief Investment Office (OCIO) business, which focuses exclusively on nonprofit institutions. Before joining Commonfund, he was an instructor of Spanish and Italian at Fordham Preparatory School in the Bronx, N.Y.