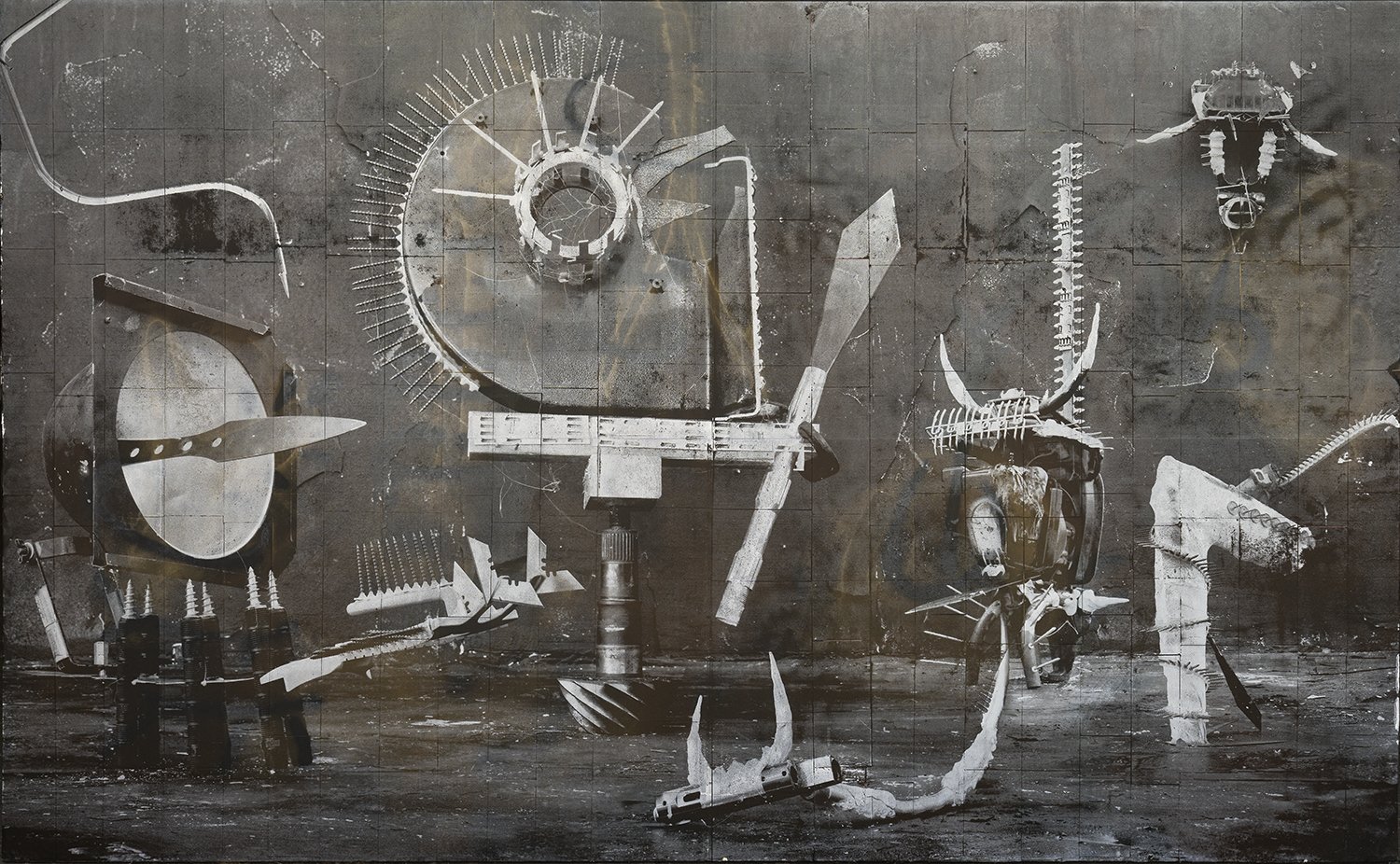

‘Sinister phoenixes’

From Chilean-born American artist Rodrigo Valenzuela’s show “Weapons,’’ at the Center for Maine Contemporary Art, Rockland, through Sept. 10.

The gallery says:

“Rodrigo Valenzuela’s exhibition incorporates works from two connected and ongoing photographic series, ‘Weapons’ and “Afterwork,’ that are integrated into floor-to-ceiling wood frame structures installed along with ceramic pieces by the artist.

“Through a patina of nostalgic fantasy, Valenzuela’s ‘Weapons’ series offers views of imaginative performances that might take place on a job site once workers depart. Knives, screws, rope, and chains—the tools of many trades—appear reconfigured as sinister phoenixes, ramshackle sculptures, and animistic creatures of dreams. ‘Afterwork’’ presents pictures of somber, silvery rooms filled with mechanical contraptions and fog, possibly from the sweat left hanging in the air after a long day’s work. Valenzuela’s works are animated by a dream-like quality and driven by an urgent human and political exploration: that of global economics and the human dimensions of labor, considered in the wake of neoliberalism.’’

Heading toward Rockland Breakwater Lighthouse

— Photo by Needsmoreritalin

Ebb and flow about issues

“Ebb & Flow” (encaustic on panel and lead), by Rockland, Maine-based painter Kim Bernard.

She says:

“I create work that is for the public, uses recycled materials, is interactive and kinetic, involves the community in the making and raises awareness about environment issues and social causes. I am particularly interested in working creatively with high-risk youth, engaging them in hands-on projects that encourage creative problem solving, collaboration, skill building and self-esteem.’’

Rockland Breakwater Light.

— Photo by Needsmoreritalin

'Doorway to the sea'

“Christina’s World,’’ by Andrew Wyeth (1917-2009), the very popular American “realist “ painter. The woman in the painting, Anna Christina Olson (1893-1968), had a degenerative muscular disorder that prevented her from walking after she was 30. She refused to use a wheelchair, so she would crawl. The house and barn are in Cushing, Maine, where the Wyeth family had a summer house.

“The world of New England is in that house – spidery, like crackling skeletons rotting in the attic – dry bones. It’s like a tombstone to sailors lost at sea, the Olson ancestor who fell from the yardarm of a square-rigger and was never found. It’s the doorway of the sea to me, of mussels and clams and sea monsters and whales.’’

-- Painter Andrew Wyeth, on the home of his model Christina Olson, in Andrew Wyeth: A Secret Life (1996), by Richard Meryman

The Olson House in 1995. The house and its occupants, Christina and Alvaro Olson, were depicted in paintings and sketches by Wyeth from 1939 to 1968. The house was designated a National Historic Landmark in June 2011. The Farnsworth Art Museum, in Rockland, Maine, owns the house, which is open to the public.

Those gorgeous book covers

Maine of the Sea and Pine, by Nathan Haskell Dole and Irwin Leslin Gordon; cover design likely Decorative Designers, Boston: L.C. Page & Company, 1928, printed by C. H. Simonds Company, first edition.

The Farnsworth Art Museum, in Rockland, Maine, is showing through March 21 “Transforming the Ordinary: Women in American Book Cover Design’’. It shows book covers from the 1890s-1930s — considered the heyday of book-cover design. The Art Nouveau and Arts and Crafts movements heavily influenced how artists, many of them women, created these book covers.

The sign includes a reference to the area’s granite-quarrying industry. Lime and shipbuilding were also important.

Launching a commercial sailing ship in 1900 in Rockland

Panorama of chaos, fear and joy

“Definitions Across All Spectrums,’’ by Norajean Ferris, at the 2020 Biennial of the Center for Maine Contemporary Arts, in Rockland, through next May 2

.

Fred Schulte: Misappropriating Native American culture to scam health-insurance seekers

Rockland is on the MidCoast of Maine.

After paying more than $9,000 in premiums and fees over 13 months to O’NA HealthCare, Jill Goodridge says, she could not get O’NA to cover her family’s medical bills. Frustrated, the Rockland, Maine, resident complained to state regulators in summer 2018. “It almost seemed like we were just spending the premium money every month for really not much,” she says. (Shelby Knowles for KHN)

Jill Goodridge was shopping for affordable health insurance when a friend told her about O’NA HealthCare, a low-cost alternative to commercial insurance.

The self-described “health care cooperative” promised a shield against catastrophic claims. Its name suggested an affiliation with a Native American tribe — a theme that carried through on its Web site, where a feather floats from section to section.

The company promises 24/7 telemedicine and holistic dental care on its Web site. It says it provides more nontraditional options than “any other health care plan,” including coverage for essential oils, energy medicine and naturopathic care. All of that and conventional care, too.

It struck Goodridge as innovative. She signed up for a high-deductible plan, paying more than $9,000 in premiums and fees over 13 months, she said. Yet she could not get O’NA to cover her family’s medical bills. For example, O’NA applied only a small portion of more than $6,000 in hospital-related bills against her $10,000 deductible.

“It almost seemed like we were just spending the premium money every month for really not much,” said Goodridge, whose family runs a Rockland, Maine, restaurant that is temporarily shuttered because of the coronavirus pandemic.

A year-long investigation by the state insurance agency prompted by her complaint concluded she was right, uncovering a business scheme operating in the gray areas of insurance regulation and tribal law to appeal to patients looking to save money on health care.

Hers is a cautionary tale for anyone looking for cut-rate coverage at a time when the cost of commercial insurance is rising and a wide range of alternatives are on offer.

Tempting low premiums may mean skimpy coverage with huge out-of-pocket expenses.

“Health insurance is getting so expensive people are looking for other options,” Maine insurance Supt. Eric A. Cioppa said. “We tell everybody that if you do business over the Internet to call us first and make sure it’s licensed.”

O’NA stood out, with a polished Web site featuring its story of holistic health and sun-dappled photographs. The sales pitch: “We’re here to guide you to a new way for your mind, body, and soul.”

Goodridge felt led astray.

The company claimed Native American ties that would exempt it from state insurance regulations because of tribal sovereignty, which gives federally recognized tribes the authority to self-govern outside of state or federal law. O’NA claimed it did not have to adhere to federal insurance requirements, such as guaranteeing standard coverage or maintaining a designated level of funds in reserve to pay claims.

O’NA HealthCare appears to be the first insurer to claim that Native American status exempted it from oversight, according to the National Association of Insurance Commissioners.

The company advertised it was “comfortably nestled under a Native American tribal corporate umbrella” and “protected by the many rights and privileges that Native American Indians enjoy today.”

It sent its customers a “tribal membership ID & benefits card.” And it said it derived its status from an affiliation with the United Cherokee Nation-Aniyvwiya. That tribe is not one of the three federally recognized Cherokee tribes.

But the troubles with O’NA went deeper than that, Cioppa and his team discovered during a year-long investigation. Along with serious doubts that anyone involved with O’NA had valid Indigenous roots, there were financial irregularities, allegations of embezzlement and phony professional credentials.

“The more we found out,” Cioppa said, “the more we wanted to keep digging.”

There was much about Goodridge’s new coverage that seemed unorthodox to the investigators.

She paid a tribal membership fee of $165, which the company said was a tax-deductible contribution to an unspecified Native American tribe. In addition to traditional medicine, O’NA said, its members could seek care at “Native American Tribal Healing Centers” nationwide, though it did not identify the centers or their locations. Goodridge also paid a family premium of $751 a month for 13 months before canceling, according to her testimony before the Maine Bureau of Insurance.

Stranger still, investigators found that O’NA required physicians to pay $485 a year to join its network. Her doctor declined.

On top of that, Goodridge testified, the plan did not pay out when needed, including much of that $6,000-plus hospital bill.

It turned out, that was not uncommon for a company that describes its services as “low cost, high value.” According to a state inspection of O’NA’s unaudited books in fall 2019, the plan spent an “unusually low” amount of the $2.5 million it collected in premiums to cover customers’ medical bills — just 13% or less. Under federal law, most insurers spend 80% or more on benefits for subscribers.

“However low its prices may be, the value it delivers is even lower,” Cioppa wrote in his December order.

Cioppa told KHN that state investigators could not determine the full scope of the operation, partly because O’NA, which boasted an “open provider network across all 50 states,” refused to tell them how many members it had signed up nationwide. It covered only 27 people in Maine.

O’NA’s bookkeeping also turned out to be suspect. Maine investigators observed that in 2019 O’NA paid few medical bills and didn’t keep enough cash on hand to handle even a couple of catastrophic illness claims, a violation of state insurance regulations.

Ultimately, Cioppa ruled that O’NA had illegally operated an insurance company, falsely advertised its benefits and failed to set aside adequate reserves to pay claims.

O’NA’s CEO, L.J. Fay, said the company is working hard to overcome past mistakes, noting: “We plan to make everything right. That is the ultimate goal.”

But in the meantime, Cioppa has prohibited O’NA from selling policies in the state.

The People Behind O’NA

Over the years, Benjamin Zvenia has presented himself at various times as a doctor, a lawyer and a tribal judge. O’NA was described by the United Cherokee Nation-Aniyvwiya as Zvenia’s “brainchild,” according to the Maine insurance bureau order.

He has a paper trail of criminal and civil infractions dating to the early 1990s, government records show.

In a sworn statement filed in Maine, Zvenia said he was a member and “administrative tribal judge” of the Nottoway Tribal Community Meherrin Band of North Carolina. That tribe is not among the 573 recognized by the federal government.

Zvenia also told Maine officials he served on the board of directors of Tribal Active Management Services, O’NA HealthCare’s parent company, but had not been paid for his “voluntary” services and had no responsibility for day-to-day operations. In a sworn statement, Zvenia denied playing a major role in O’NA. He did not respond to repeated requests for comment for this story.

Zvenia, in fact, has a criminal conviction in Nevada for practicing medicine without a license, which prohibits him from overseeing an insurance company, according to Maine officials. He was sentenced to six years in prison, court records show.

In his statement, Zvenia wrote, “There was a crime, and I did the time. My previous history may be public information, but it is not part of my accomplishments today.”

Zvenia’s legal work also has drawn scrutiny. In March 1999, the Nevada Supreme Court removed him from a list of non-attorney arbitrators, citing his undisclosed criminal conviction. A State Bar of Nevada investigation found Zvenia had applied to practice in immigration court, claiming to hold a law license issued by the Supreme Court of the Federated States of Micronesia. But the state bar checked with Micronesia, and it could not verify his claims.

Zvenia also told a state bar investigator that he graduated from the Kensington College “School of Law” in California. The college said Zvenia had applied in June 1994 but “never completed enrollment,” according to an exhibit filed with the Nevada Supreme Court order.

Jill Goodridge took a chance on a nonprofit “health care cooperative” sold online by a Native American company called O’NA HealthCare. After paying more than $9,000 in premiums and fees over 13 months, Goodridge says, she could not get O’NA to cover her family’s medical bills. (Shelby Knowles for KHN)

A founder of O’NA HealthCare was Alan Boyer, a Utah musician who said he was a member of the Cherokee Nation. He was born in West Yorkshire, England, and emigrated to the U.S. in 1998, when he was nearly 40 years old.

Boyer was a founder of a British-style brass band in Utah but also dabbled in the holistic healing arts and naturopathic products before his death in December 2018 from cancer at age 59. In one promotional video for O’NA, Boyer, who spoke with a pronounced British accent, said the word O’NA means “new beginnings.”

“One of Alan’s greatest achievements in his later years was acceptance as a sovereign member of the great Cherokee Nation,” reads an online obituary entered into the record in the Maine proceeding.

Maine regulators had their doubts: “It does not appear from the record that any Native Americans have been involved at any time in the establishment, management or operation of O’NA,” reads the state order.

Lisa Hughes, the former CEO of O’NA and a resident of the Salt Lake City area, also raised Maine regulators’ eyebrows. Investigators found Hughes’ online résumé shows more than a decade of experience in rocket engineering and consulting work in Utah. She recently told Maine officials she had been hired at O’NA because of her prior experience in “systems development and cashflow analysis.”

In an affidavit and other legal filings filed in January, Hughes asserted she worked for O’NA for several years “with no or very reduced salary” before the company suspended her in July 2019 amid a corporate power struggle. The next month, O’NA sent her a letter from a law firm accusing her of embezzling $295,000, filings in the Maine investigation show.

In her affidavit, Hughes said O’NA concocted the embezzlement accusations “for purposes of smearing me and making me the scapegoat for O’NA’s legal formation and structure.”

Lessons Learned ― Or Not

In his December order, Cioppa gave the insurer until Jan. 21 to create a $100,000 fund to satisfy any outstanding medical claims. O’NA failed to do so, and now state officials are seeking a $450,000 penalty, though they aren’t optimistic about collecting it.

Today, O’NA has promised to reinvent itself as a “different type of insurance company,” according to CEO Fay. She said in an affidavit that it is anticipating a capital infusion of as much as $120 million and has $500,000 in reserves in a money market account in a Salt Lake City bank. She also indicated the company would file for a license to legally operate in Maine. So far, that has not happened.

Zvenia is still active online, offering professional and consulting services through Zvenia and Associates in Las Vegas, which says on its Web site that it is a “law firm guided by Benjamin Zvenia, Dr PH, JD.” The site posts a disclaimer: “All Nevada State legal matters are referred out; our lawyers & advocates are not licensed to practice Nevada State law.”

O’NA presents a new wrinkle in an ongoing conflict: The states regulate insurance but the internet allows for nationwide sales, leaving consumers basically on their own.

Goodridge, the Maine consumer who sparked the investigation, said in an interview that she holds little hope of getting any money back. But she has kept other Mainers from the same troubles.

Though O’NA health plans are still available in many states, its website notes that coverage is “not available in Maine.”

Fred Schulte is a Kaiser Health News reporter.

What I 'expected Maine to look like'

Downtown Rockland in the summer, when it’s a major tourist center

“Catawamteak,” meaning “the great landing,” is what the Abenaki Indians called the early settlement that became Rockland, Maine. Thomaston and Rockland can be bypassed by Route 90, an eight-mile shortcut which I frequently used as a midshipman, but our bus stayed on the main road and stopped to let passengers on and off in both places. At one time Rockland was part of Thomaston, called East Thomaston, but the two towns have long since separated, having very little in common. In the beginning, Rockland developed quickly because of shipbuilding and limestone production. It was, and still is, an important fishing port. Lobsters are the main export and the five-day Maine Lobster Festival is celebrated here annually. The red, three-story brick buildings lining the main street of Rockland, give it the image of an old working town. I have always been impressed by the appearance of these small towns, because to me this is what I had expected Maine to look like.’’

— Capt. Hank Bracker, in his book Salty & Saucy Maine: Sea Stories From Castine

Rockland in 1908

Trying to get at time in Rockland

“Continuum (Magenta)’’ (oil on linen — detail), by Grace DeGennaro, at the Center for Maine Contemporary Art, Rockland, through Feb. 23.

The gallery says:

”This exhibit is the second in an ongoing series at CMCA that addresses common themes in contemporary art. The biennial series began in 2017 with ‘Materiality | The Matter of Matter’ and continues to ‘Temporality’ with the work of 14 contemporary artists. ‘Temporality’ explores our deepest questions about the concept of time: What is time, how do we measure it, how can we ascribe value to it? The featured artworks offer their own answers to these questions using painting, photography, sculpture, installation, video and other media. However, one can say that time itself is also a medium in these pieces, as the exhibit webpage points out: The only sure things about time are that "artists need time to make their work and viewers need time to look. ‘Temporality,’ therefore, asks the viewer to slow down and take the time to consider the questions it asks about time and perhaps find the answers.’’

xxx

Rockland, on Penobscot Bay, is a fascinating place — a celebrated arts center, a fishing port and a major recreational-sailing center. Besides the CMCA (designed by the internationally known architect Toshiko Mori), the town is also home to the Farnsworth Museum of Art, which has paintings by Andrew Wyeth and other well-known New England artists. It hosts the Maine Lobster Festival, held annually in honor of the town's primary export: lobster. Rockland's downtown has many small shops, some very charming, including coffee shops, book stores, art supply stores, restaurants, organic markets, computer repair and toy stores. The city's dramatic breakwater, built in the 19th Century, draws tourists.

Downtown Rockland

Some of Rockland’s waterfront

— Photo by Jeff G.

The North Woods in wax

“Tree Variation #6 ‘‘ (encaustic on panel), by Helene Farrar. She is a member of New England Wax, which promotes the art of encaustic painting, which uses bee’s wax.

From her bio:

“Hélène Farrar has taught and worked in the visual arts for twenty years while actively exhibiting in commercial, nonprofit and university galleries in New England, New York City, Pennsylvania, Italy, and England. Farrar has a BA in Studio Art from the University of Maine and a Masters of Fine Art Degree in Interdisciplinary Arts from Goddard College in Vermont.

“Hélène currently owns and operates her own private art school in Maine out of her ‘Farmhouse’ studio, where she holds varied workshops and classes. Her paintings have most recently been accepted into curated exhibits at the Fuller Craft Museum, the Saco Museum, the University of New England Art Gallery, and Twiggs Gallery in New Hampshire.

“Farrar is represented by Archipelago Fine Arts in Rockland, and the Center for Maine Craft in West Gardiner. Her work as an educator has brought her across the state of Maine including the Haystack Mountain School of Craft. She taught at the 2019 International Encaustics Conference.’’

'All day long on the coast of Maine'

Rockland around 1908. It was Edna St. Vincent Millay’s birthplace.

“If I could see the weedy mussels

Crusting the wrecked and rotting hulls,

Hear once again the hungry crying

Overhead, of the wheeling gulls;

Feel once again the shanty straining

Under the turning of the tide,

Fear once again the rising freshet,

Dread the bell in the fog outside,

I should be happy!—that was happy

All day long on the coast of Maine.

I have a need to hold and handle

Shells and anchors and ships again.’’

— From “Exiled,’’ by Edna St Vincent Millay (1892-1950), a native of the Maine Coast