Chris Powell: How many jobs were actually created by Conn. state fund? Stop companies from looting hospitals

Chimera. Apulian red-figure dish, ca. 350-340 BC

MANCHESTER, Conn.

Connecticut's state auditors are on a roll with their critical report about state government's "venture-capital firm," Connecticut Innovations, which was published the other day soon after the critical audits about expensive management failures at Central Connecticut State University, the state Department of Energy and Environmental Protection, and the Correction Department.

The problem with Connecticut Innovations, the auditors say, is that the agency, which spends tens of millions of dollars investing in new companies in the state, can't be sure that the companies have produced all the jobs they promised to produce with state government's investment. According to the auditors, Connecticut Innovations says verifying the job numbers would require auditing the companies and the companies can't afford it. Connecticut Innovations adds that while the state Labor Department has data about employment at the companies, it's always out of date.

This explanation is weak. Surely without much cost the subsidized companies can quantify their employment at regular intervals and identify their employees by names, address, and hours worked. Connecticut Innovations then could do spot checks about the claimed employees. This wouldn't be foolproof but it would be better than simply accepting the data provided by the subsidized companies as Connecticut Innovations does now.

Connecticut Innovations says it will try to figure something out, though the issue may be forgotten unless the General Assembly presses it.

The auditors' report on Connecticut Innovations should be taken by the legislature as an invitation to reconsider the agency in its entirety. For even if the job-creation data reported to Connecticut Innovations could be verified comprehensively, it would not mean the agency's subsidies were essential.

For the world is full of banks and investment firms that finance new businesses. Who can be sure that the jobs at companies subsidized by Connecticut Innovations couldn't have been created anyway with private financing? Why does state government need to get into the venture capital business any more than it needs to get into any other business?

Of course a venture capital firm operated by state government can provide one thing more readily than a private venture-capital firm can -- political patronage for those who run the government.

In any case if Connecticut had an economic and political climate more favorable to business and wealth creation than to employment by and dependence on government, state government might not feel as compelled to play favorites and subsidize certain businesses. A better economic and political climate would be the best innovation of all.

Better late than never -- and in the middle of his campaign for re-election -- Connecticut U.S. Sen. Chris Murphy has noticed the looting of Waterbury, Manchester Memorial, and Rockville General hospitals by the California-based investment company, Prospect Medical Holdings, which purchased them from their nonprofit operators in 2016 and began mortgaging their property and stripping their assets to pay big dividends to its investors.

This kind of thing has become a nationwide racket, and Murphy cited the Connecticut angle last week during a Senate hearing about the bankruptcy of Steward Health Care, a for-profit company that recently ran three hospitals in Massachusetts into bankruptcy.

Murphy asked: "How have we let American capitalism get so far off the rails, so unmoored from the common good, that anybody thinks it's OK to make a billion dollars off of degrading health care for poor people in Waterbury, Connecticut?"

The answer is simple. It is less a matter of capitalist greed than government's negligence. That is, in Connecticut and elsewhere government has allowed profit-making companies to acquire nonprofit hospitals and extract for profit the decades of public charity that built them.

Federal and state law could prohibit such transactions. So how about it, Senator, Gov. Ned Lamont, and state legislators? And Senator, how about returning the $2,500 campaign contribution you received from Prospect's political action committee in 2017, a year after it acquired the Connecticut hospitals, a contribution reported this week by political blogger Kevin Rennie?

Chris Powell has written about Connecticut government and politics for many years (CPowell@cox.net).

Chris Powell: Don't leave looted Conn. hospitals' fate to a big game of chicken

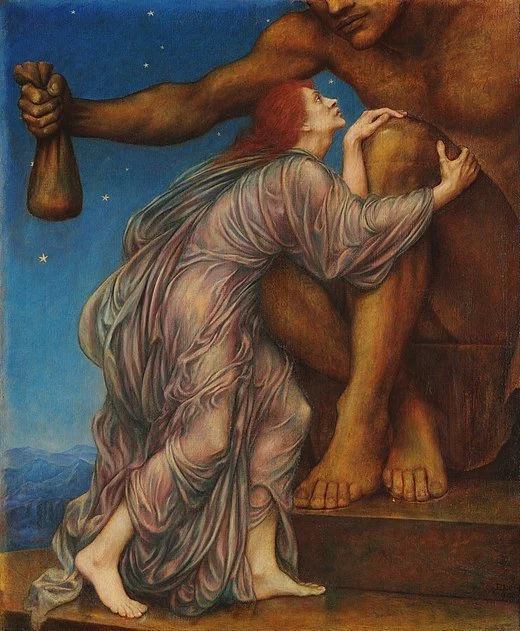

“The Worship of Mammon,’’ by Evelyn De Morgan (1909).

MANCHESTER, Conn.

A big game of chicken may determine what becomes of Waterbury (Conn.) Hospital, Manchester (Conn.) Memorial Hospital, and Rockville General Hospital, in Vernon, Conn.

Yale New Haven Health, which two years ago agreed to buy the three struggling hospitals from Prospect Medical Holdings for $435 million, now is suing Prospect to nullify the agreement. Yale New Haven Health contends that Prospect has substantially impaired the hospitals by mismanagement since the agreement was made.

Prospect's Connecticut hospitals were already in terrible financial condition, most of their equity having been stripped from them and liquidated by their parent company, Leonard Green and Partners, a private-equity investment firm based in California. The Prospect hospitals no longer own their own real estate but must pay rent to a real-estate company.

Connecticut law never should have allowed nonprofit hospitals, which Waterbury, Manchester and Rockville were, to be acquired by investment companies like Prospect. The state now has a big interest in keeping the hospitals operating, restoring their solvency, and returning them to nonprofit status.

But Yale New Haven Health has a big interest in not overpaying for an operation that may be on the verge of collapse and bankruptcy. After all, Yale New Haven Health runs four hospitals in Connecticut, all nonprofits, and they could be critically weakened if their parent company pays too much for the Prospect hospitals.

As the condition of the Prospect hospitals deteriorated after Yale New Haven Health agreed to acquire them, Yale New Haven Health asked state government to subsidize its purchase by $80 million. Gov. Ned Lamont didn't want to do that and urged the two sides to keep negotiating. But with the acquisition unfulfilled after two years and the lawsuit charging bad faith, negotiations have failed and seem unlikely to resume soon. The Prospect hospitals are far behind in paying bills and state and municipal taxes. They may not have any net worth left at all.

But the Prospect hospitals serve large communities and their closure would be a disaster for Connecticut. Other hospitals are not prepared to take up the displaced patient load, and even if they could handle it, many patients of the failing hospitals and the doctors who treat them would have far to travel. The disruption to medical care in the state would be immense. Despite Prospect's awful ownership and top management, its hospitals employ hundreds of dedicated professionals striving to provide excellent care under worsening financial stress.

State government's financial intervention in support of an acquisition by Yale New Haven Health strikes many as the obvious solution.

But a state subsidy for the purchase will ratify Prospect's looting of its three hospitals and the real-estate company's purchase of the hospitals' property. The real-estate company now may think it has decisive leverage over whoever acquires the hospitals and intends to keep them operating. But if the hospitals fail and go out of business, their buildings probably would lose much of their value, since they have practical use only as hospitals.

The best mechanism for saving the hospitals may be to let them fail and go into bankruptcy. Bankruptcy is exclusively a federal court process but with the court's approval state government could become a party to the case and assist the financial reorganization of the hospitals from the moment of their bankruptcy filing. Bankruptcy could relieve the hospitals of their burdensome property rental obligations.

In any case state government should do more than what it long has been doing about this problem -- just hoping that Yale New Haven Health and Prospect will work things out eventually before the Prospect hospitals collapse and close. Hope is not a strategy or plan.

So the governor should assemble a team ready to assist a bankruptcy proceeding, the General Assembly should make millions of dollars in an emergency loan available to a new owner of the hospitals, and the legislature and governor should give Connecticut a law to prevent nonprofit hospitals from falling into the hands of predators ever again, and thus to prevent the theft of decades of community charity that state government's negligence allowed here.

Chris Powell has written about Connecticut government and politics for many years (CPowell@cox.net).

Brown U. tries to fend off expansionist Partners HealthCare

Part of the Warren Alpert Medical School, aka the Brown Medical School, in Providence.

Adapted from Robert Whitcomb’s “Digital Diary,’’ in GoLocal24.com:

Brown University’s plan to join with for-profit Prospect Medical Holdings to buy Care New England to fend off Partners HealthCare’s bid for CNE is motivated by a very reasonable fear. Partners is joined at the hip with the Harvard Medical School. Letting the Partners behemoth into Rhode Island would result in many patients and clinicians who might otherwise stay in Rhode Island going to Partners’ famous Harvard-affiliated hospitals in Greater Boston, perhaps ravaging the small Brown Medical School in the process.

Indeed, Partners would suck a lot of oxygen out of the Ocean State’s health-care sector. But the takeover looks full-steam ahead. Partners’ Massachusetts General Hospital and Brigham and Women’s Hospital may well already be planning to welcome many new patients from Little Rhody.