Josh Hoxie: Debunking myths about class and race

From OtherWords.org

I don’t get that much hate mail — except when I write about race.

This spring I co-authored a report called “Ten Solutions to Bridge the Racial Wealth Divide.” My coauthors and I found that the median white family today owns 41 times more wealth than the median black family and 22 times more wealth than the median Latinx family.

To fix it, we proposed new public programs, changes to the tax code, and a commission to study reparations for slavery, among other things.

The floodgates opened. My inbox, along with many comment sections at news outlets and on social media, overflowed with angry objections. Most of these blamed the wealth divide on poor individual decision making by people of color.

Are black families 41 times worse at decision making than white families? No — that’s a racist falsehood.

In fact, here are the three most common racist falsehoods I heard about the wealth divide — with data to explain why they’re wrong. Feel free to bust this out at your next family get-together.

Falsehood No. 1: Black and Latinx families have less money because they’re led by single parents.

Nope. A 2017 study from Demos and the Institute on Assets and Social Policy showed that single-parent white families have twice as much wealth as two-parent black and Latinx families.

In other words, raising kids in a two-parent household doesn’t close the racial wealth divide.

Falsehood No. 2: Black people are poor because they’re less educated.

Hard no. A 2015 study titled “Umbrellas Don’t Make It Rain” found that black families led by college graduates “have about 33 percent less wealth than white families whose heads dropped out of high school.”

In fact, according to that 2017 Demos study, “The median white adult who attended college has 7.2 times more wealth than the median black adult who attended college and 3.9 times more wealth than the median Latino adult who attended college.”

In other words, higher education doesn’t close the racial wealth divide.

Falsehood No.3: Black people don’t work or are bad with money.

Definitely not. Demos found that white families actually spend more and save less than black families with the same income. Yet white families have way more wealth than black families with the same income.

The Umbrellas adds that “white families with a head that is unemployed have nearly twice the median wealth of black families with a head that is working full-time.”

In other words, not even income alone can close the racial wealth divide.

So if these arguments are all false, what’s really going on here?

The simplest answer is a history of oppression and inherited advantage. The impacts of slavery, sharecropping, Jim Crow, white capping, red lining, mass incarceration, and predatory subprime lending, among many other things, are still very much with us.

Many white children, by contrast, start life with a more robust safety net of family wealth. It may be as small as getting a few hundred bucks from their parents when they really need it, or as big as a few hundred thousand for things like college, weddings, or their first home.

Addressing these problems is a lot harder than blaming oppressed people for their hardship. But if we’re going to address racial disparities in this country, we must heed James Baldwin’s challenge that “nothing can be changed until it is faced.”

It’s not individual behavior that drives the racial wealth divide — it’s a system that many folks pretend doesn’t exist.

Josh Hoxie directs the Project on Taxation and Opportunity at the Institute for Policy Studies.

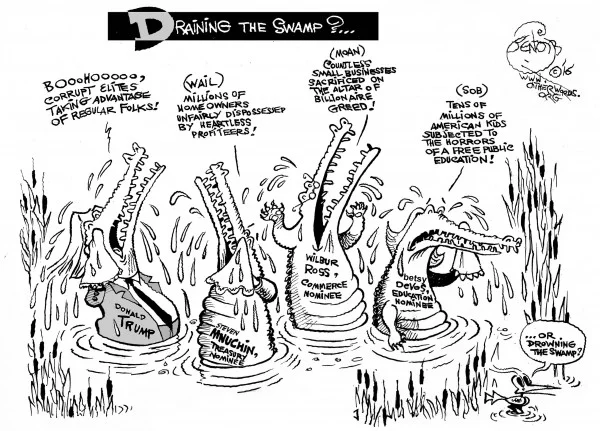

Josh Hoxie: Sucker voters give Wall Street more power and money than ever

During the campaign, Donald Trump said he wanted to fix our rigged economic system. And we can’t do that, he said, by counting on the people who rigged it in the first place.

He talked a big game about Wall Street and the big banks. He repeatedly called out Goldman Sachs, the Wall Street behemoth, by name in ads and speeches, characterizing the firm as controlling his rivals Hillary Clinton and Ted Cruz.

So it should come with some shock, at least to Trump voters, that now President-elect Trump has chosen a consummate Wall Street insider, Steve Mnuchin, for Treasury secretary.

Mnuchin spent 17 years as an executive at Goldman Sachs before continuing his lucrative career as a banker and investor. Is this not the swampiest of characters that Trump vowed to drain away?

Trump’s anti-Wall Street messaging resonated with millions of voters. A poll taken just before the election showed that nearly 70 percent of undecided voters in key swing states wanted to break up the big banks and cap their size to avoid another financial crisis.

The same proportion wanted to close the “carried-interest loophole,” an insidious provision that enables hedge-fund managers to pay lower taxes than nurses.

It’s unclear whether Trump’s anti-Wall Street messaging made the difference for these voters. But it’s abundantly clear that he didn’t mean a word of it.

In Washington, personnel is policy. And Mnuchin’s appointment casts serious doubt that Trump will follow through with any of his bluster on Wall Street.

Mnuchin isn’t just any Goldman Sachs alumnus: He oversaw one of the largest foreclosure operations in the country. Mnuchin bought mortgage lender IndyMac in 2009, renamed it OneWest, and continued on as its chair through 2015 — a period in which OneWest foreclosed on more than 36,000 families.

What exactly does Mnuchin want to do while in power?

In his first announcement, Mnuchin exclaimed his “number one priority is tax reform,” promising to work with Congress to pass the “biggest tax cut since Reagan.” He claims the benefits of this tax cut will go to middle-class families, rather than the upper class.

Fortunately, tax plans, unlike campaign promises, can be easily and quickly fact checked. Unfortunately, Mnuchin’s statement comes back pants-on-fire false.

Over half of the cuts in Trump’s proposed tax plan would exclusively benefit the top 1 percent, according to the non-partisan Center on Budget and Policy Priorities. The plan would increase their after-tax income by 14 percent, 10 times more than for middle-income earners.

Mnuchin won’t be the only Wall Streeter in the Trump administration. Steve Bannon, the chief strategist for the president-elect and former head of the white supremacist “news’’ outlet Breitbart, is a fellow former Goldman Sachs employee.

The Wall Street swampiness of both Mnuchin and Bannon, however, pales in comparison to that of Wilbur Ross, the billionaire investor selected by Trump to lead the Commerce Department. The 79-year-old investor built a career on greed, exploitation and apparent tone deafness. Ross infamously whined in 2014, “The 1 percent is being picked on for political reasons.”

These former Wall Streeters will have serious power overseeing major parts of the government and the overall economy.

It’s been just eight years since Wall Street bankers had to come to Washington, hat in hand and utterly humbled, to ask for a taxpayer funded bailout. The reforms put in place to prevent a repeat of the 2008 crisis are tenuous at best — and now they’re under serious threat from the same people they were designed to rein in.

Josh Hoxie directs the Project on Taxation and Opportunity at the Institute for Policy Studies. Distributed by OtherWords.org.