Sam Pizzigati: How taxpayers funded 'consulting fees' for Ivanka Trump

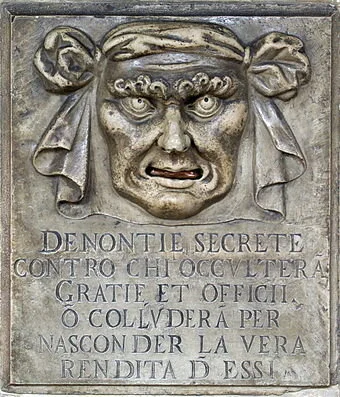

A "Lion's Mouth" postbox for anonymous denunciations at the Doge's Palace, in Venice. Translation: "Secret denunciations against anyone who will conceal favors and services or will collude to hide the true revenue from them."

Via OtherWords. org

BOSTON

The warmest and fuzziest phrase in the political folklore of American capitalism? “Family-owned business”!

These few words evoke everything people like and admire about the U.S. economy. The always welcoming luncheonette. The barbershop where you can still get a haircut, with a generous tip, for less than $20. The corner candy store.

But “family-owned businesses” have a dark side, too, as we see all too clearly in the Trump Organization. We now know — thanks to the recent landmark New York Times exposé on Trump’s taxes — far more about this sordid empire than ever before.

Put simply, the report shows how great wealth gives wealthy families the power to get away with greed grabs that would plunge more modest families into the deepest of hot water.

Let’s imagine, for a moment, a family that runs a popular neighborhood pizza parlor. Melting mozzarella clears this family-owned business $100,000 a year. The family owes and pays federal income taxes on all this income.

Now let’s suppose that they had a conniving neighbor who one day suggested that he knew how the family could easily cut its annual tax bill by thousands.

All the family needed to do: hire its teenage daughter as a “consultant” — at $20,000 a year — and then deduct that “consulting fee” as a business expense. That move would sink the family’s taxable income yet keep all its real income in the family.

The ma and pa of this local pizza palace listen to all this, absolutely horrified. Their daughter, they point out, knows nothing about making pizzas. How could she be a consultant? Pretending she was, ma and pa scolded, would be committing tax fraud.

The chastened neighbor slinks away.

Donald Trump goes by a different standard. Between 2010 and 2018, Trump’s hotel projects around the world cleared an income of well over $100 million. On his tax returns, Trump claimed $26 million in “consulting” expenses, about 20 percent of all the income he made on these hotel deals.

Who received all these “consulting” dollars? Trump’s tax returns don’t say. But New York Times reporters found that Ivanka Trump had collected consulting fees for $747,622 — the exact sum her father’s tax return claimed as a consultant-fee tax deduction for hotel projects in Vancouver and Hawaii.

All the $26.2 million in Trump hotel project consulting fees, a CNN analysis points out, may well have gone to Ivanka or her siblings.

More evidence of the Trump consulting hanky-panky: People with direct involvement in the various hotel projects where big bucks went for consulting, The Times notes, “expressed bafflement when asked about consultants on the project.” They told the paper that they never interacted with any consultants.

The New York Times determination: “Trump reduced his taxable income by treating a family member as a consultant and then deducting the fee as a cost of doing business.”

During the 2016 presidential debates, Donald Trump dubbed his aggressive tax-reducing moves as “smart.” Now, veteran tax analysts have a different label: criminal. Daniel Shaviro, a tax law prof at New York University, feels that “several different types of fraud may have been involved here.”

Ivanka Trump, adds former Watergate prosecutor Nick Akerman, had no “legitimate reason” to collect consulting fees for the Trump hotel projects “since she was being paid already as a Trump employee.” Donald and Ivanka Trump, says Akerman, should with “no question” be facing “at least five years in prison for tax evasion.”

Plutocrats don’t play by the same rules as pizza parlors, and that won’t change so long as Donald Trump remains in the White House. But these new revelations may make that a harder sell.

Sam Pizzigati, based in Boston, co-edits Inequality.org for the Institute for Policy Studies. He’s the author of The Case for a Maximum Wage and The Rich Don’t Always Win. This op-ed was adapted from Inequality.org and distributed by OtherWords.org.

Jim Hightower: Rapacious Trump's huge tax lies

An old saying asserts that falsehoods come in three escalating levels: Lies, damn lies and statistics. But now there’s an even higher category of lies: a Donald Trump speech.

Take his recent address on specific economic policies he’d push to benefit hard-hit working families, including an almost-hilarious discourse on the rank unfairness of the estate tax.

“No family will have to pay the death tax,” he solemnly pledged, adding that “American workers have paid taxes their whole lives, and they should not be taxed again at death.”

But workers aren’t taxed at death. The first $5.4 million of any deceased person’s estate is already exempt from this tax, meaning 99.8 percent of Americans pay absolutely zero. And the tiny percentage of families who do pay estate taxes are multimillionaires — not workers.

Of course, Trump knows this. He’s shamefully trying to deceive real workers into thinking he stands for them, when in fact it’s his own wealth he’s protecting.

In the same speech, he offered a new childcare tax break to help working families by allowing parents to fully deduct childcare costs from their taxes. With a tender personal touch, Trump said his daughter Ivanka urged him to provide this helping hand to hard working parents because “she feels so strongly about this.”

Another deception — 70 percent of American households don’t have enough yearly income to warrant itemizing deductions. So the Americans most in need of childcare help get nothing from Trump’s melodramatic posturing.

Once again, his generous tax benefits would only flow uphill to wealthy families like his, giving the richest Americans a government subsidy for purchasing platinum-level care for their kids.

As another old line goes: “Figures don’t lie, but liars do figure.”

Jim Hightower is a radio commentator, writer, and public speaker. He’s the editor of the populist newsletter, The Hightower Lowdown. This first ran on OtherWords.org.