David Warsh: Trying to figure out how to measure ‘inflation’

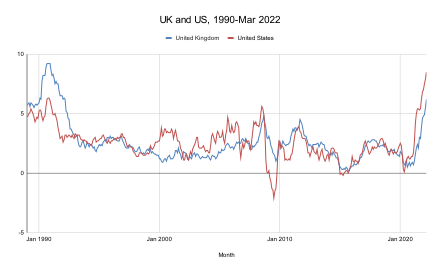

British and U.S. monthly inflation rates from January 1990 to February 2022.

SOMERVILLE, Mass.

President Biden calls it Putin’s inflation. Federal Reserve Board Chairman Jerome Powell says the problem began with the pandemic. Harvard University economist Lawrence Summers blames the Fed. Who’s right? Some 250 years of interplay between the science of pneumatics and its technological applications were the background against which economist Irving Fisher, in 1928, expanded the modern usage of the term “inflation” to mean something more than rising prices. Fisher is not a bad place to begin to look for an answer.

Arguments about whether or not such a thing as a vacuum can exist; quicksilver (meaning mercury); barometers; j-tubes; air pumps; valves, cylinders, and plungers; hot air balloons; footballs; the discovery of inert gases (starting with helium); the manufacture of incandescent light bulbs; pressure cookers; inflatable tires – these topics or objects became familiar before Fisher took advantage of relationships among pressure, volume, and temperature of gases, itself by then vaguely understood, in order to attach a new meaning to an old word.

“Anyone… reading [The Money Illusion] (Adelphi, 1928) by Fisher, or other books on monetary affairs published in this period, may have some difficulty with terminology” wrote Fisher’s biographer, Robert Loring Allen, many years after the fact. “For more than a generation, the words ‘inflation’ or ‘deflation’ [had] usually meant increasing or decreasing prices.” But in The Money Illusion. Allen wrote, Fisher coined new meanings: “the words inflation and deflation refer to the money supply, not to prices. Money inflates and in consequence prices rise and a deflation in the money supply causes falling prices.”

It was the first and only book about the subject that Fisher, a prominent Yale University professor and tireless reformer, would write for the general public. He was at pains to explain what he meant.

As I write, your dollar is worth about 70 cents. This means 70 cents of pre-war buying power. In other words, 70 cents would buy as much of all commodities in 1913 as 100 cents will buy at present. Your dollar now is not the dollar you knew before the War. The dollar always seems to be the same but it is changing. It is unstable. So are the British pound, the French franc, the Italian lira, the German mark, and every other unit of money. Important problems grow out of this great fact – that units of money are not stable in buying power.

A new interest in these problems has been aroused by the recent upheaval in prices caused by the World War. This interest nevertheless is still confined largely to a few special students of economic conditions, while the general public scarcely yet know that such questions exist.

Why this oversight?.. It is because of “the Money Illusion”; that is, the failure to perceive that the dollar, or any other unit of money, expands or shrinks in value. We simply take it for granted that “a dollar is a dollar” –that “a franc is a franc” that all money is stable, just as centuries ago, before Copernicus, people took it for granted that that the earth was stationary, that there was really such a fact as a sunrise or a sunset. We know now that sunrise and sunset are illusions produced by the rotation of the earth around its axis, and yet we still speak of, and even think of, the sun rising and setting!

Fisher is at pains to illustrate the illusion. He visits Germany with an economist friend, where the two interview 24 men and women. Only one considered that rising prices have anything to do with the government’s management of its currency.

They tried to explain it by ‘supply and demand’ of other goods, by the blockade; by the the destruction wrought by the War; by the American hoard of gold; by all manner of other things – exactly as in America when, a few years ago, we talked about “the high cost of living,” we seldom heard anybody say that a change in the dollar had anything to do with it.

Fisher went on to explain the system of gold, paper money, and bank “deposit currency,” as bank credit was known at the time. He noted that the Federal Reserve System had recently taken responsibility for the oversight of the money supply that occurred via the purchase and sale of government bonds by its Open Market Committee. He noted the suspension of the international gold standard during the World War and recommended its early resumption. Above all, he urged the adoption of price indices, carefully collected by government agencies, with which to measure changes in “the cost of living,” or, as he puts it, “fluctuations in the value of money.”

But the year was 1928. A world-wide boom was on. Fisher was already somewhat isolated from his university colleagues by his enthusiasm for business (he had sold his Rolodex card-filing system to Remington Rand Corp. and was trading millions in stocks). When the Depression began, instead of hedging his bets, he pursued business as usual a little while longer, and gradually lost his entire fortune. Meanwhile, economists turned their attention to John Maynard Keynes.

“It was particularly unfortunate,” Robert Dimand, of Brock University, has written, “that Fisher lost the attention of the economics profession, the public, and even his Yale colleagues just when he has something interesting to say about with what had gone wrong with his predictions and the economy,” to wit his article “The Debt-deflation Theory of the Great Depression” in the first volume of Econometrica, in lieu of an Econometric Society presidential address. He died in 1947.

But Fisher’s espousal of the value of index numbers to monitor variations in purchasing power stuck, as did his enthusiasm for the monetary, as opposed to real, explanation of rising prices. In Monetary Illusion, Fisher never mention Boyle; he offers a more homely analogy instead: “If more money pays for the same good, their price must rise, just as if more butter is spread over the same slice of bread, it must be spread thicker, the thickness representing the price level, the bread the quantDity of goods.” Twenty five years later, though, a master expositor of Keynesian economics, George Shackle, of Liverpool University, wrote,

How did we come to adopt the portentous word “inflation” to mean no more than a general rise in prices? I think this usage must have had its origin in a particular theory of the mechanism or cause of such a rise. When a given weight of gas is released from a steel cylinder into a large silk envelope, there may appear to be more gas, but in important senses, the amount of gas is unchanged. In a somewhat analogous way, we can make our total stock of currency spread over a larger number of paper notes, but this action in itself will not increase the size of the basket of goods (where various good are present in fixed proportion) that this total stock of currency would exchange for in the market…. Some such image as this may perhaps have been n the mind of the man, who first spoke of inflating the currency. This idea, that the general price level is closely related to the ostensible, apparent size of the money stock… has become formally enshrined in what is called the Quantity Theory of Money.

It’s been nearly 40 years since I published The Idea of Economic Complexity. What have I learned, in all the years since, about explaining generally rising prices? At least this: By all means let us continue to measure money and talk pneumatics. In hopes of narrowing differences of opinion, though, let us keep looking for something real and general in the economy to measure as well. I expect that the Fed has made a pretty good beginning on that.

David Warsh, a veteran columnist and an economic historian, is proprietor of Somerville-based economicprincipals.com, where this essay originated.