Chris Powell: Enough pandering and stereotyping already!

Statue of Christopher Columbus in New Haven. In 2017, the statue was vandalized before Columbus Day, with red paint splashed on the statue and the words "kill the colonizer" spray-painted along its base.

The statue was removed on June 24, 2020.

MANCHESTER, Conn.

Has Connecticut been more Balkanized or less so by Groton's decision to replace its observance of Columbus Day with a holiday that will be both Italian Heritage Day and Indigenous Peoples Day?

Columbus is now considered politically incorrect for having helped to open the Western Hemisphere to the European exploration and colonization that displaced the hemisphere's original inhabitants, who had spent hundreds of years displacing each other without European interference. Political correctness lately has elevated them to the "noble savages" of old romantic literature.

But a century ago Columbus was a worldwide hero, and since he was Italian he was appropriated for a national holiday apologizing for the scorn that had been heaped on the Italian immigrants of recent decades, as scorn had been heaped on the Irish immigrants before them and even then was being heaped on Jews.

So in Groton and other places Italian Heritage Day will be what Columbus Day was meant to be all along, more a sop to people of Italian descent than a tribute to the great navigator. Meanwhile the descendants of the inhabitants displaced long ago by the Europeans are getting Indigenous Peoples Day, also as an apology for the abuse their ancestors took, as if most people in the United States now aren't just as "indigenous" as anyone with "indigenous" ancestors.

Why must the country keep patronizing ethnicity? While people may gain much identity from their ethnicity, no one has earned anything by it. It is simply bequeathed to them and they deserve no credit for it any more than anyone should be disparaged for it. But politicians love to pander on the basis of ethnicity, especially when they have little to say about anything that matters.

It is 2½ centuries since the national charter declared that all men are created equal. Lately the charter seems to have been amended to add that, as George Orwell wrote, some are more equal than others.

The pandering to people of Italian and "indigenous" descent as if they deserve an apology or special recognition of their acceptance is especially silly in Connecticut. The state has the country's largest percentage of people of Italian descent and two of its three largest Indian casinos, which enjoy lucrative monopolies bestowed on the premise that today's reconstituted tribes are owed tribute for the wars lost by their ancestors nearly four centuries years ago. Apparently the fantastic wealth given to the tribes by the state, much of that wealth being extracted from people who are far more oppressed than the proprietors of the casinos ever were, isn't apology enough. Supposedly a special holiday is needed too.

But there is already a holiday that celebrates everyone in the country: Independence Day, July 4. It marks the supreme principle of equality under the law. When will that ever be enough?

For that matter, when will high school sports teams and their followers acknowledge that mascots drawn from an ethnic group -- particularly those drawn from Indians -- constitute stereotyping and that stereotyping ethnic groups is offensive?

That has yet to dawn on school systems in Windsor, Canton, Killingly and Derby, though most towns have replaced their Indian mascots, and state law penalizes use of such mascots by withholding financial aid drawn from the Indian casinos.

Windsor and Canton remain the "Warriors," which may sound ambiguous but is not, since the teams formerly used Indian imagery with the name. Killingly's teams are the "Redmen" and "Red Gals," a reference to skin color, also confirmed by past use of Indian imagery. Derby still gets away with "Red Raiders" because it has the endorsement of a minor tribe, the Schaghticokes, which long has been trying to curry favor with palefaces in hope of winning casino rights.

The stereotype here is undeniable -- that of ferocity and brutality. No team calls itself the Fighting Bunnies.

State government's financial incentives to replace Indian mascots haven't finished the job. Such mascots should be forthrightly outlawed by the next session of the General Assembly.

Chris Powell has written about Connecticut government and politics for many years (CPowell@cox.net).

Manmade and thus disposable

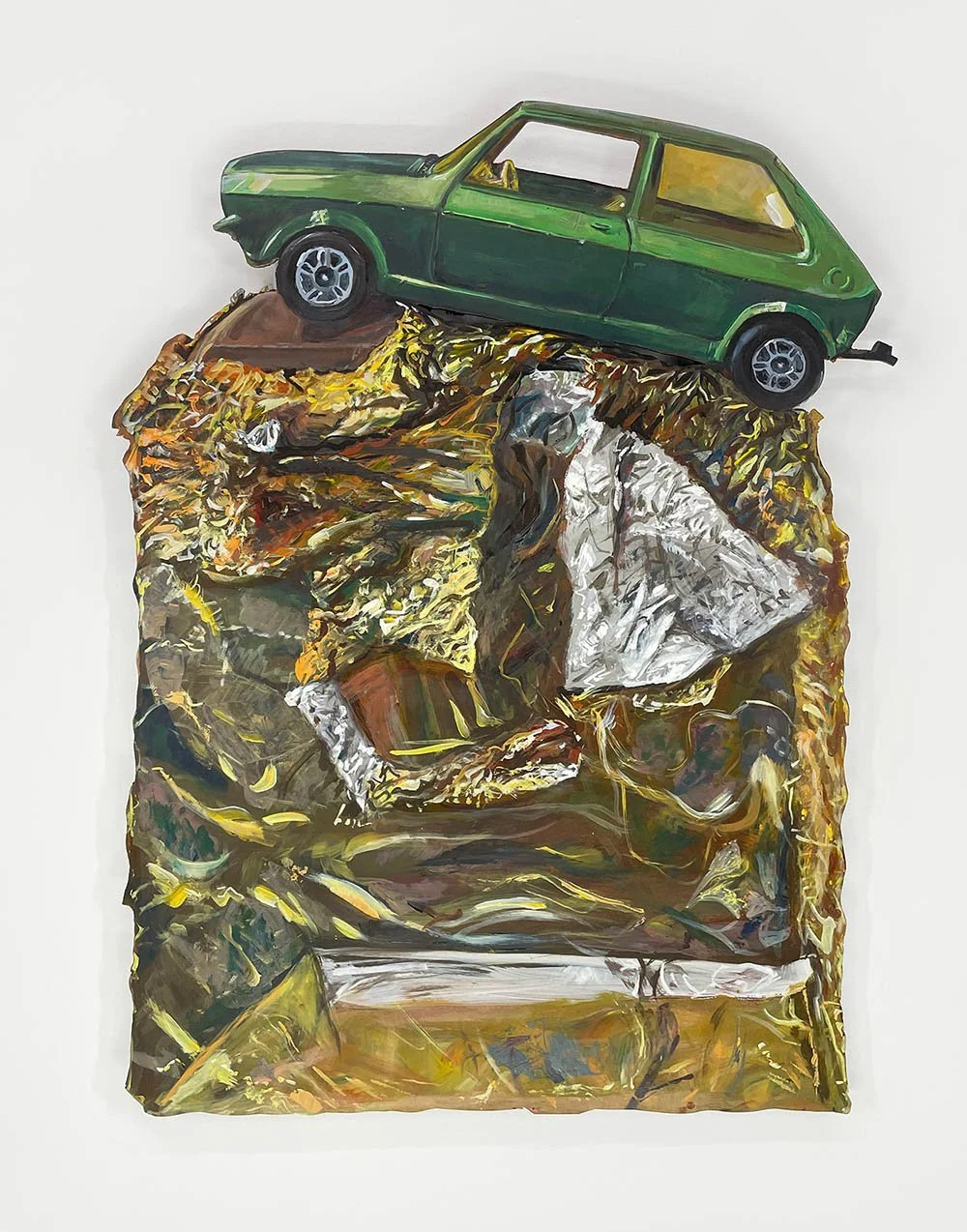

"Car and Candy Bar” (acrylic on panel), by Groton, Mass.-based Caleb Brown, in his show “Playdate,’’ at Bromfield Gallery, Boston, through May 1.

The gallery says that the show consists of still-life paintings of “personal ephemera arranged as on a child’s whim and then left behind, as though a play date has just ended.

“Cut from Masonite panels, the still lifes evoke an unfussy trompe l'oeil style.’’

Gibbet Hill in Groton. According to tradition, the name comes from an incident in Colonial times when a Native American was hung at the summit of the hill. Wikipedia: “A gibbet is any instrument of public execution, but gibbeting refers to the use of a gallows-type structure from which the dead or dying bodies of criminals were hanged on public display to deter other existing or potential criminals.’’

— Photo by John Phelan

Don Pesci: Conn.’s temporary gasoline-tax cut and trying to repeal economic common sense

Major roads of Connecticut

VERNON, Conn.

The default position of Connecticut’s majority Democrats on the matter of getting and spending has not changed within the past three decades: Tax cuts, infrequently imposed, should be temporary and bravely endured, while tax increases, deployed for the most part to satisfy imperious state-employee-union demands, should be permanent.

The recent temporary suspension of Connecticut’s 25-cent-a-gallon excise gasoline tax conforms to the default position of Democrats who have controlled Connecticut’s General Assembly for the last 30 years: The tax is to be suspended – operative word – “temporarily” from April to July 1.

Connecticut Democrats, it should seem obvious, are reading from a national Democratic script.

The increase in the price of gasoline, they say, is due chiefly to the Russian war of aggression in Ukraine and the greedy oil barons.

The debate in the General Assembly on reducing Connecticut’s gasoline tax centered upon whether the reduction should be temporary or permanent.

“Rep. Sean Scanlon, a Guilford Democrat who co-chairs the tax-writing committee,” one newspaper noted, “said many constituents have been hurting from the rising prices at the pump, which was recently an average of $4.32 a gallon.

“Our constituents did not start a war in Ukraine,’' Scanlon argued. “Our constituents did not contribute to the global supply chain. ... This is a great first step that we can make to give them some affordability, some relief. ... At least we’re doing something.”

The newspaper correctly noted, “The tax cuts are possible partly because the state has large budget surpluses in two separate funds due to increased federal stimulus money and capital gains taxes from Wall Street increases, paid largely by millionaires and billionaires in Fairfield County.”

In the state Senate chamber, also dominated by Democrats, Will Haskell, of Westport, rose to the occasion. Haskell argued that the gasoline-tax cut should not be permanent because providing permanent relief would deliver a “debilitating blow’' to the state’s plans to spend millions of dollars to fix roads and bridges. The paper quoted Haskell: “Gas prices are high, but not because of taxes. It’s because of [Russian dictator Vladimir] Putin.”

The federal government – which prints money, borrows money and acquires money through excessive taxation – is flush with funds now being distributed by the Biden administration to various political receptacles, some say for political purposes. In many instances, states are using the funds to offset business slowdowns caused by, some argue, imprudent decisions made by governors and federal officials that have produced a worker shortage. Common sense tells us that if you provide a living salary to workers not to work, they will not work.

High business taxes, an increase in the supply of money flowing from private pockets to the public purse, and labor shortages have produced too few goods, resulting in inflation – too many dollars chasing too few goods.

The high price of goods and services may also be attributed to a continuing effort by progressives in the United States to repeal a central law of a free-market economy, the law of supply and demand, which holds that when demand is a constant and supply is diminished, prices on all goods and services rise. The rise in prices has less to do with the greed of billionaire CEOs than a Darwinian survival-of-the fittest-impulse in over-regulated markets centrally directed by Washington politicians. Large business can survive a large regulator drag on profits. Higher taxes and an increasing regulatory burden swamp smaller businesses and, of course, make it much easier for the larger fish to swallow the minnows.

The empty shelves in Russian stores during the good old days of the Soviet Union were attributed by underpaid “workers of the world” in Russia to central planning. In the so-called “captive nations,” the necklace of states now threatened militarily by Vladimir Putin, workers used to joke among each other, “We pretend to work, and they pretend to pay us.”

The Democratic Party program runs against the grain of good sense. Every worker in the United States knows that personal debt should be discharged by responsible debt holders willing to cut spending and pay down the debt.

Temporary reductions in taxes are insufficient to pay down a debt in Connecticut that has swelled over the years to about $57 billion. And given past performance, no one in the state can be certain that increased taxes will be put to such purposes by an administrative apparatus, growing daily, that had in the past raided various Connecticut lockboxes to pay for current expenses.

The solution to Connecticut’s most pressing economic problems is disarmingly simple: Enrich the state’s creative middle class by cutting taxes and regulations, pay down debt, and work hard to dissolve the entangling alliances between a tax-thirsty government and an even more tax-thirsty conglomeration of various state employee unions.

Don Pesci is a Vernon-based columnist.

The Mystic River Bascule Bridge, built in 1922, carries US 1 over the Mystic River in Connecticut. The famous span connects Groton with the Stonington.

‘No propaganda value whatsover’

“Forget” (monotype and encaustic collage on panel), by Groton, Mass.-based artist Jeanne Borofsky

She writes in her Web site:

“Having grown up in the country I have always looked to nature to center myself – to restore balance to my mind and my world. I spend time in the woods or by the water letting the rhythms of the world become part of me. I create encaustic monotypes with patterns reminiscent of barks and leaves or water, and collage them onto panels, adding many bits of ephemera, both natural and not.

“My encaustic constructions (“castles”) usually start with encaustic monotypes. There is a monotype mounted to the panel, and I add origami boxes folded mostly from more encaustic monotypes. I spend a lot of my time folding, which is a kind of meditation, and then more time constructing and adding stamps, maps, bits of asemic writing and other ephemera to create my own world. I have often felt the way Alexander Calder felt when he said, ‘I want to make things that are fun to look at, that have no propaganda value whatsoever.’

“Stamps, maps and electronic bits are ever present in my work, nothing seems complete without one or the other. Creatures abound, and sometimes they are the main focus of my attention.

“I love the way beeswax creates both physical and visual depth and translucency to my work – adding to the mystery and magic I’m trying to understand and convey. Whatever I put into my art, it always includes the joy of creation, the love of art, and the happiness in my ability to create it.’’

Chapel at the Groton School, an elite Episcopalian boarding school.

Don Pesci: And now Conn. considers a wealth-repelling 'mansion tax'

The Branford House, in Groton, Conn., on the Avery Point campus of the University of Connecticut, which rents it out for events. Branford House was built in 1902 for Morton Freeman Plant, a local financier and philanthropist, as his summer home; he named it after his hometown of Branford, Conn. The house is on the National Register of Historic Places.

VERNON, Conn.

”There will be time, there will be time

To prepare a face to meet the faces that you meet.’’

– T.S. Eliot

Connecticut is running out of time to prepare a face to meet the faces it will meet. “The whole world is watching,’’ as kids in the Sixties used to say when, caught in the grip of an unwanted war, TV cameras showed them sticking flowers in the barrels of National Guard rifles warding them off .

Clever politicians may hide behind their own designer masks, but the face that Connecticut presents to the world and other states cannot be hidden. The question that politicians in Connecticut should be asking, and acting upon, is this one: What is the face that Connecticut has been presenting during the last few decades to revenue producers? Is it attracting or repelling the entrepreneurial capital that the state desperately needs to finance both its operations and its best prompting from the angels of its better nature?

Consider a recent story in a Hartford paper titled “Lamont tells Connecticut businesses he opposed ‘mansion tax.’” The mansion tax is the latest sunburst from Martin Looney, the most progressive president pro tem of the state Senate in Connecticut history.

The Looney state property tax would be levied on the assets of millionaires in Connecticut. The mansion tax, we are told in the story, will “funnel more money to municipal governments.… It will raise $73 million a year as part of a package to provide property-tax relief for cash-strapped communities like his hometown of New Haven.-

The quickest and most efficient way of shuttling money from state coffers to municipalities is to reduce any tax and allow people in municipalities to retain their own assets. Doing so would avoid the trip that a dollar makes from the municipality to the state and back again – minus administrative costs – to the municipality. But this method would short circuit the progressive afflatus and considerably reduce the political influence of progressive redistributors. One imagines Looney gagging on such a solution as being too simple, workable and efficient.

The new mansion tax drew an immediate response from millionaire Gov. Ned Lamont: “I don’t support it. I don’t think it’s going anywhere, and I don’t think we need it,” Lamont told “Chris DiPentima, president of the Connecticut Business & Industry Association” on a webcast conference call.

Lamont, we are told, issued his comment “a day after a public hearing among state legislators who called for a separate 5 percent surtax on capital gains, dividends and taxable interest.” In addition, the progressive legislators want to increase the personal-income-tax rate for earners making more than $500,000 a year and couples earning more than $1 million annually.

In addition, progressive lawmakers – nearly half the Democrat caucus in the General Assembly are progressives – “support reducing the Connecticut estate tax exemption of $2 million and [eliminating] the current cap on payments that would yield higher” revenue payments from millionaires in the state who foolishly decide to remain on the spot, there to be cudgeled and deprived of their assets by tax greedy progressives.

This concerted attack on wealth accumulation in Connecticut is designed, consciously or not, to drive creative revenue production out of the state the way St. Patrick once drove serpents out of Ireland and, in the long run, the effort will succeed. Millionaire snakes will slither out of Connecticut on their way to enrich competing states.

Seen from outside the state, what does the face of Connecticut look like?

Well, it is among the highest taxed states in the nation; business flight is rampant; out-of-state companies have gobbled up Connecticut home-grown companies, such as, United Technologies, now merged with Raytheon Technologies, based in Waltham, Mass.; Sikorsky, now owned by Lockheed Martin, headquartered in Bethesda, Md.; Aetna Insurance Company, now a subsidiary of CVS Health, which is based in Woonsocket, R.I.; Colt firearms, bought by the Ceska Zbrojovka Group, a Czech company; and it seems likely that The Hartford, a company that once insured Abe Lincoln’s home in Illinois, will in the near future be bought by Chubb, incorporated in Zürich, Switzerland. This is not a fetching portrait of Connecticut's face, but it is an accurate one.

This is not a fetching portrait of Connecticut's face, but it is an accurate one.

When the Coronavirus high tide recedes, very quickly now, it will leave on the shore the wreckage of Connecticut’s economy that had been apparent to everyone before the Wuhan, China, virus arrived in our state. Connecticut, if it is to remain competitive with other states, must address a legion of problems that cannot be settled by politicians more interested in saving their seats than their state. The state’s spending spree, unchecked since 1991, must be addressed. Taxes are too high, and politicians much too clever and committed, body and soul, to unchecked spending, neither of which advances the public good.

Don Pesci is a Vernon-based columnist.

Chris Powell: Do we need these subs for anything but jobs?

USS Nautilus moored in Groton at the Submarine Force Museum

MANCHESTER, Conn.

Since it's not considered sensible to ask the barber if you need a haircut, how is it any more sensible to ask members of Congress from Connecticut if the country needs more attack and ballistic-missile submarines when many are made at Electric Boat in Groton?

Many years ago it was sometimes possible to find a member of Congress from Connecticut who opposed, at least nominally, one stupid imperial war or another, as long as ending the war would not reduce military contracting in the state. But not today. While all the members of Connecticut's congressional delegation are liberal Democrats, each seems indifferent to the prospect of another 20 years of war in Afghanistan, though most Connecticut residents might not be able to find the country on a map.

The big achievement of Joe Courtney's seven terms in the U.S. House from Connecticut's 2nd District, which includes Groton, has been his persuading the federal government to build two attack submarines a year. Courtney has been extremely conscientious about this. He got on the House Armed Services Committee and eventually obtained the chairmanship of its subcommittee on sea power, and he is expert in all the rationales for the United States to fill the oceans with subs built at EB.

The other day Courtney induced the navy secretary to visit the EB shipyard, in part to evaluate whether the company has the capacity to keep building two attack subs each year while starting to build the new generation of missile submarines, the current generation being 30 years old and replacing it having higher priority with the Defense Department than producing a second attack sub every year.

The military rationale for all these submarines might be more persuasive if the state's congressmen weren't also so easily persuaded to sustain the endless war in Afghanistan.

It also might be more persuasive if the federal government hadn't recently concluded amid the virus epidemic that money is infinite and so can be created out of nothing forever as a claim against not only this country's production but the whole world's as well, and without ever wrecking the currency and whatever is left of the market economy.

Not that Connecticut has much interest in the military rationale for the submarines -- or for the jet engines, helicopters, and other weapons of war manufactured in the state. In his official biography, Courtney himself ignores the military rationale for more subs, concentrating instead on the jobs they sustain in his district.

Connecticut might consider Courtney a hero even if he had persuaded the federal government to award EB the same value of contracts to make not submarines but obsolescences like typewriters and video-cassette recorders, which, after all, dropped from B-52s high above Afghanistan, might be more effective against the religious crazies below than any tactics now being used by U.S. forces there.

Of course Courtney and his colleagues in the Connecticut delegation might face some plausible competition for re-election if they ever questioned the military rationale for the products requisitioned here by the Defense Department. Can anyone elected on a state or district level dare to pursue a national interest above a local or special interest? Certainly not if his constituents cannot themselves distinguish between those interests.

Thus big government erodes the principles of nearly everyone in office if it doesn't make them hypocrites. Thirty years ago no one observing Courtney's work as a liberal state representative chairing the General Assembly's Human Services Committee would have guessed that he would go down in history for building the deadliest warships. But even liberal Democrats in Connecticut must serve the military-industrial complex above all, just as conservatives in the Midwest must pledge allegiance to farm subsidies, and politicians of every inclination must propitiate most of what's big enough -- if not the investment banks, then the government employee unions. Some manage to serve both the banks and the unions.

Does anybody in politics really believe in a public interest, believe in anything besides whatever favors his own advancement? And if anybody really did believe in a public interest and expressed some original thought and independence about it, would anyone vote for him?

Chris Powell is a columnist for the Journal Inquirer, in Manchester.

Chris Powell: Why are Conn. and R.I. giving EB piles of money to do what it would do anyway?

USS Nautilus moored in Groton at the Submarine Force Museum.

What was the necessity of Connecticut Gov. Dannel Malloy's award the other day of $80 million to the Electric Boat Division of General Dynamics in Groton? {Rhode Island is giving the very rich company $34 million in incentives to expand at Quonset Point.}

The governor said that in exchange for the money, the company will increase its local employment by 1,900 people over the next 16 years, a state subsidy of $42,000 per job. But the federal government already had given the company the extra submarine work that was requiring that expansion of its workforce.

That is, the Malloy administration is paying EB to do what it was doing anyway, and as a military contractor EB is already getting all its money from government.

So was the state's payment necessary to keep EB in Connecticut, to prevent the company from moving to another state? That seems improbable, given EB's huge facilities in southeastern Connecticut and Rhode Island. They would not easily be relocated. Further, any risk of relocation would not speak well of Connecticut's congressional delegation, whose agitation for more submarine construction is partly responsible for the extra work coming to EB. With the federal government spending billions more on submarines, EB probably would not have minded being required to stay put.

While the governor called the state's payment to EB a "partnership," it looks more like corporate welfare from an administration that senses that, with its constant increases in taxes and business regulations, it has crippled the state's economy and feels ever more vulnerable to extortion by major corporations.

And does the Navy really need the extra submarines? As long as military contracting is such big business in Connecticut, that issue will get no more serious inquiry from the state's political leaders than the war in Afghanistan, now in its 18th inconclusive year.

xxx

SUBVERTING THE CONSTITUTION: The General Assembly and Governor Malloy are moving to put Connecticut into the "national popular vote" system of determining the votes of the state's presidential electors and thus determining the election of the president. Under the proposal Connecticut's electors would be required to vote for the candidate who led the national presidential vote.

There are many problems with this plan, starting with its subversion of the Constitution by undoing the Electoral College without a constitutional amendment and it making a compact among states without the approval of Congress as required by the Constitution.

Advocates of the "national popular vote" system say it would ensure that every vote for president counts, but it wouldn't. For it would nullify the votes of states on the minority side and diminish the influence of Connecticut and other small states, whose electors now represent more voters than the national average. The proposed system would have canceled Connecticut's votes in the 2004 presidential election, when Democrat John Kerry carried the state but lost the national vote to Republican George W. Bush. Connecticut's advocates of the "national popular vote" system seem to think that this state can never be on the minority side nationally, but it has been.

And just how is the national popular vote to be officially counted and totaled? There are no such counts and totals. The secretaries of the 50 states count only their own state's votes and certify their electors

The Electoral College has its disadvantages but so does the "national popular vote" system. The proposal would allow political corruption in "sanctuary states," nullifiers of federal immigration law -- particularly California and New York -- to steal more than their allotted electoral votes and control presidential elections by facilitating voting by their millions of illegal immigrants.

Chris Powell is a columnist for the Journal Inquirer, in Manchester, Conn.